Brand Story – Employers are always looking for ways to enhance benefit plans and reduce risk.

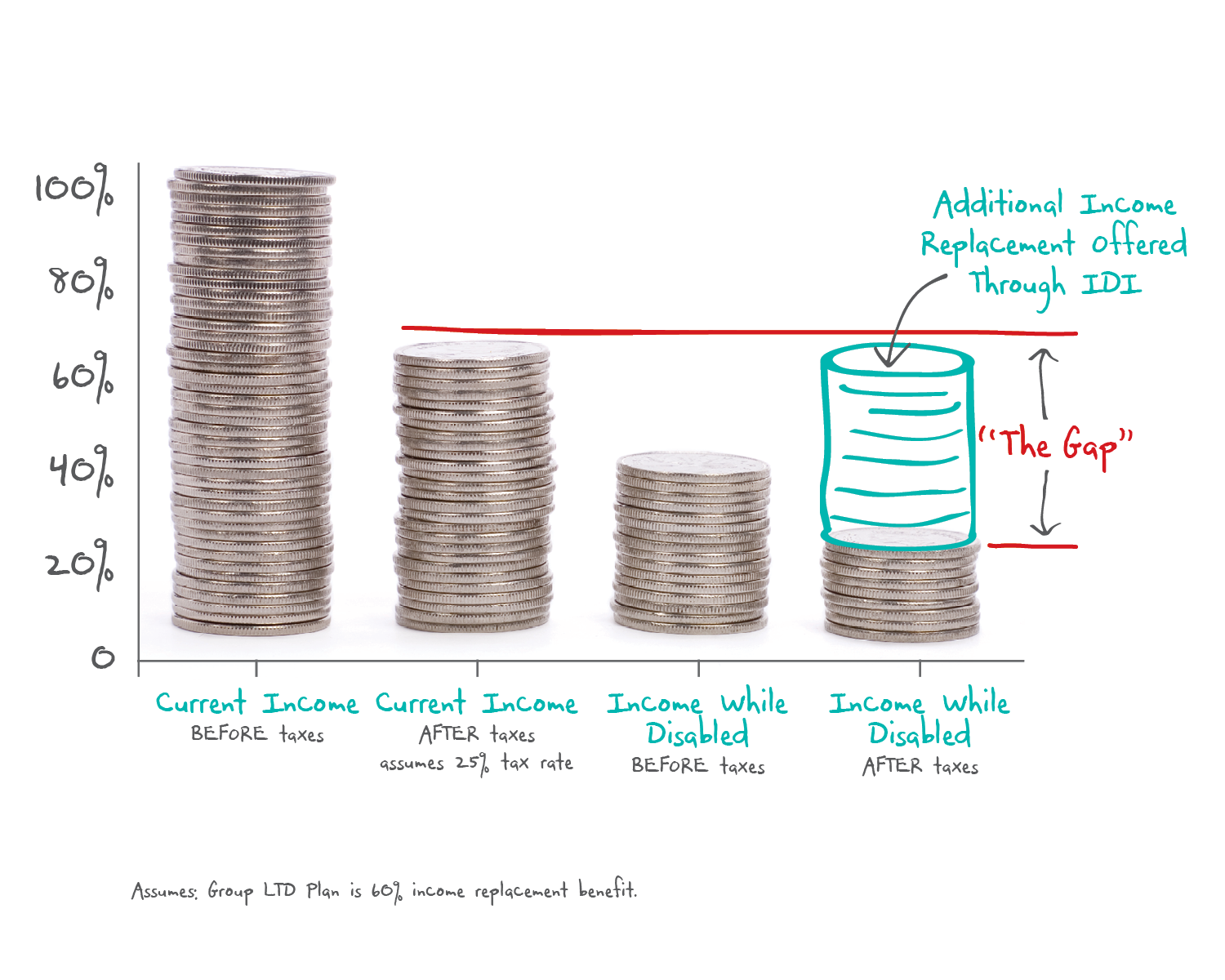

Combining group long term disability (LTD) and individual disability insurance can result in a more comprehensive disability program that maximizes protection for the employer and employees. Group LTD plans are a cost-effective way to provide paycheck protection to all employees, but group plans can rarely protect executives and higher earners to the same extent. For example, a group LTD plan with a $5,000 monthly benefit maximum does not adequately cover employees making more than $100,000 per year.

Individual disability insurance provides supplemental coverage that complements the base LTD plan and prevents reverse discrimination (i.e. when high earners do not receive coverage that protects their total income, but lower earners receive a benefit that does). According to a SHRM survey, 78 percent of employers say that their long term disability plans don’t include coverage for bonuses or commissions, and two out of three employers surveyed report that about 20 percent of their employees are affected by the benefit cap.

Employer advantages of executive and/or supplemental disability insurance include:

• Attracting and retaining talent, because coverage meets the needs of higher earners and provides better benefits and more comprehensive coverage for all employees.

• Providing coverage (employer-paid or voluntary) to a certain class of employees.

• Providing more comprehensive disability coverage for employees in terms of plan features, such as own occupation protection to the end of the benefit period, and/or Social Security Normal Retirement Age.

• Achieving discounts based on volume.

• Easing administration with full benefit education and enrollment support (online, in-person, or telephonic).

• Adding stability and predictability to LTD costs by reducing the group LTD maximum and transferring this amount to an individual disability plan.

Two out of three employers surveyed report that about 20 percent of their employees are affected by the benefit cap.

All employers can benefit from executive and/or supplemental disability plans. White-collar employers, such as law practices, architecture firms, and physicians, may pay for coverage on all professionals, while employers that are primarily blue-collar, such as manufacturing firms, can benefit from providing a carve-out plan for their higher earners.

There are many ways to structure disability plans and an experienced benefits consultant can work with you to make sure the plans offered align with your benefit strategy and company goals. The most common plan design consists of employer-paid group LTD insurance and employee-paid individual disability insurance.

Some employers choose to offer voluntary group LTD and employer-paid individual insurance for their high-value employees.

Plans can also be designed to provide employer-paid LTD insurance for all employees, with an employer-paid executive carve out for individual disability insurance and voluntary individual disability insurance for other employees. There are many options available for employers of all shapes and sizes.

A good place to start the process of reviewing your disability coverage is comparing your group LTD monthly maximum benefit with the average total income of your top five earners. If your group LTD plan doesn’t fully cover high earners, then executive and/or supplemental individual disability insurance can provide a more comprehensive disability program that benefits the employer and employees.

Parker, Smith & Feek is a full-service brokerage firm providing commercial insurance, risk management, surety, benefits, and personal insurance solutions. Janae Sorenson is a Vice President and an Account Executive in Parker, Smith & Feek’s Portland Benefits Department. She works with clients in a variety of industries, including Healthcare, Nonprofits, Technology, and Professional Services. Janae’s tenure as President of a life and disability insurance carrier provides her with a unique perspective when consulting with clients on life, disability, voluntary, and executive benefits. This specialty has allowed her to gain experience partnering with national and global employers. A frequent speaker and published author of the benefits industry, she has a passion for creating robust benefits plans that cut costs for both employers and employees. Contact Janae at (503) 416-6874 or [email protected].

References and Resources:

1. https://www.shrm.org/hr-today/trends-and-forecasting/research-and-surveys/pages/shrm-massmutual-disabilitybenefits.aspx