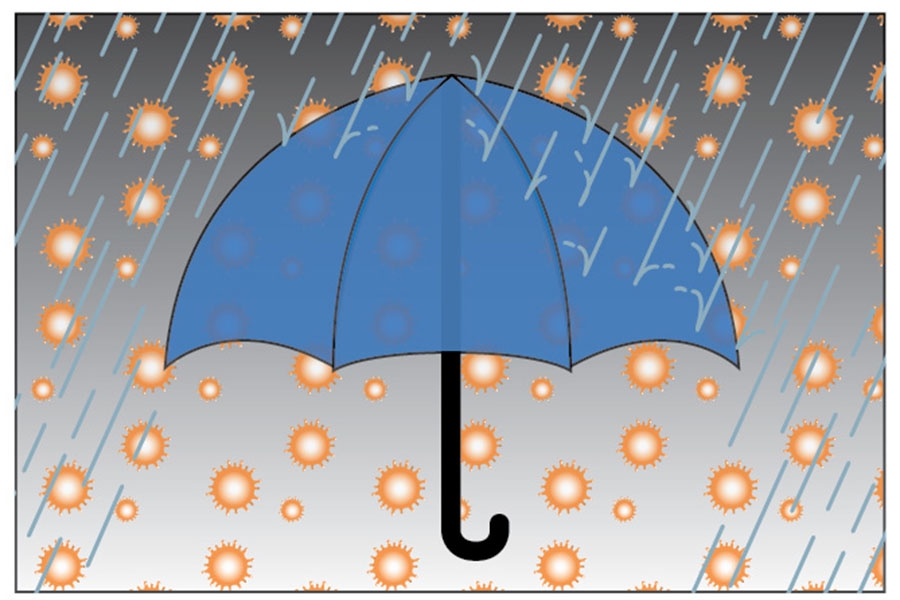

Insurers are expected to deny businesses compensation for loss of revenue resulting from the pandemic.

With many companies forced to close for the foreseeable future because of COVID-19, businesses are turning to their insurance policies to claim money for loss of revenue.

But those policies may not pay out as easily as many would hope.

Frank Weiss, partner at law firm Tonkon Torp, says he has been “flooded” with requests from clients to review business interruption insurance policies.

He is blunt about how insurers may react: “What I think you will see is a lot of insurers will try to deny the claims,” he says.

Around 50% of insurance policies contain language that excludes coverage for business interruption caused by a virus or bacteria, says Weiss.

Many insurers inserted exclusions after the spread of the SARS (Severe Acute Respiratory Syndrome) virus in 2003.

Unsurprisingly, few businesses have paid attention to the exclusionary language in their policies, given that the massive economic disruption caused by a virus such as COVID-19 is unprecedented in recent history.

Even Weiss admits he used to pay little attention to clauses excluding business interruption from a virus because it was always a non-issue.

Many organizations have business interruption coverage as part of their property insurance policies. For example, if a business had to shut down because of fire damage, the policyholder could claim compensation for loss of revenue from the destruction of the building.

“Some insurers will try to claim there is no property damage” from the business interruption caused by COVID-19, says Weiss.

Although insurers will deny many claims, Weiss says coverage may prove to be broader than carriers will claim.

“Tons of businesses will be surprised they will be in a fight on this,” says Weiss.

In anticipation of the denial of claims, some states are proposing legislation requiring insurers to cover business interruption for COVID-19-related claims despite the virus exclusions.

New Jersey has proposed such a bill. Gov. Kate Brown is also considering legislation, says Weiss.

But he adds some will argue against the constitutionality of such legislation.

Whatever the outcome, it is clear many businesses will not receive compensation promptly if settlement has to be resolved in the courts.

This will be little comfort to businesses in an extreme cash crunch.

“It is not satisfactory if you need to pay money to employees next month,” says Weiss.

To subscribe to Oregon Business, click here.