Revenues in Oregon’s private, for profit sector maintained solid growth as the economy continued to rebound.

Revenues in Oregon’s private, for profit sector maintained solid growth as the economy continued to rebound

| Central | 6 |

| Portland Metro | 105 |

| Southern | 11 |

| Willamette Valley | 28 |

| By Oregon Employees | |

| More than 1,000 | 10 |

| 501-1,000 | 18 |

| 251-500 | 23 |

| 101-250 | 51 |

| 51-100 | 30 |

| 50 or fewer | 18 |

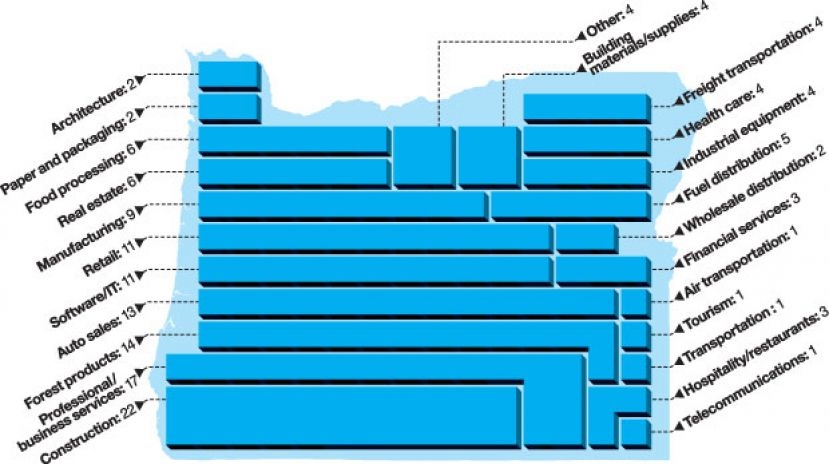

The financial recovery was on full show in the overall revenue growth of companies in this year’s Private 150 list. Hiring is also on the upswing as employment levels in the state’s private sector increased.

Total revenue for this year’s Private 150 grew 4% from last year to $38.3 billion. Earnings growth from companies reporting annual revenue for both this year and last was even stronger, increasing 7%. Average annual revenue of the Private 150 is $252 million, a 3% bump on last year.

Companies with the strongest year-over-year growth include health care (20%), auto retailers (17%) and food processors (11%). Other sectors showing modest gains are retail (4%) and professional services, including legal (4%).

Oregon’s growing reputation as a tech- sector hub is also evident in the revenue growth of software and IT companies reporting earnings for the list. Revenues for the sector grew 19% year over year. A recent study by the Oregon Office of Economic Analysis ranks Portland at No. 14 for the concentration of tech jobs in a sampling of metro areas. The city is still well below other cities such as San Jose, Washington, D.C., and Boston.

The surge in technology outpaced growth in Oregon’s more traditional industries of manufacturing, construction and forest products. Manufacturing revenues, which include high-tech manufacturing, grew 10% year over year. Construction was mostly flat with a 0.2% growth rate, while the forest products sector gained 8%.

Not all industries represented in the roster saw revenue growth. Overall annual earnings declined for real estate and fuel distribution sectors. Earnings for both industries declined 7% year over year.

Employment in the private sector is also on the upswing. This year’s Private 150 provided 49,734 jobs, a 7% uptick on last year. This compares to a drop in job levels in last year’s list, where the number of staffers employed at Private 150 companies in 2014 declined 3.4% on the prior year. The number of employed in the state as a whole increased 2% between April 2014 and April 2015, according to figures from the State of Oregon Employment Department.

JELD-WEN remains at No. 1 in the list, where it has been since 1996. The iconic Southern Oregon maker of doors and windows moved its North American headquarters to Charlotte, North Carolina, in 2012. Moda Health inched up to No. 3 from the No. 4 spot last year, moving Hoffman Construction down one position to No. 4. Knowledge Universe, No. 6, announced in July that it had brought on Swiss-based Partners Group as a new owner. Roseburg Forest Products climbed one spot to No. 8, knocking ESCO Corporation, a metal manufacturer, to No. 9.

MORE THAN $1 BILLION

| 2015 RANK | 2014 RANK | COMPANY | SENIOR EXECUTIVE | YEAR ESTAB. CITY | EMPLOYEES: OREGON/TOTAL INDUSTRY |

| 1 | 1 | JELD-WEN* | Kirk Hachigian President and CEO | 1960 Klamath Falls | 2095 / 20000 Manufacturing |

| 2 | 2 | Forest City Trading Group | Craig Johnston President and CEO | 1964 Portland | 136 / 418 Forest products |

| 3 | 4 | Moda Health | Robert G. Gootee CEO | 1991 Portland | 1796 / 1816 Health care |

| 4 | 3 | Hoffman Construction Company | Wayne Drinkward President and CEO | 1922 Portland | 259 / 428 Construction |

| 5 | 5 | Les Schwab Tire Centers | Dick Borgman CEO | 1952 Bend | 2248 / 6460 Retail |

| 6 | 6 | Knowledge Universe — United States | Tom Wyatt CEO | 1983 Portland | 946 / 25696 Health care and education services |

| 7 | 7 | Hampton Affiliates | Steven J. Zika CEO | 1942 Portland | 710 / 1500 Forest products |

| 8 | 9 | Roseburg Forest Products | Allyn C. Ford Chairman and CEO | 1936 Roseburg | 2223 / 2861 Forest products |

| 9 | 8 | ESCO Corporation | Calvin W. Collins President and CEO | 1913 Portland | 783 / 4616 Metals manufacturing |

| 10 | 10 | Reser’s Fine Foods | Mark Reser President | 1959 Beaverton | 850 / 4500 Retail |

$250 MILLION TO $1 BILLION

| 2015 RANK | 2014 RANK | COMPANY | SENIOR EXECUTIVE | YEAR ESTAB. CITY | EMPLOYEES: OREGON/TOTAL INDUSTRY |

| 11 | 12 | Columbia Distributing | Gregg Christiansen Chairman and CEO | 1935 Portland | 1150 / 2600 Wholesale distribution |

| 12 | 13 | Bi-Mart Corporation | Marty W. Smith Chairman and CEO | 1955 Eugene | 2700 / 3300 Retail |

| 13 | 11 | EPIC Aviation | W.S. Conley President | 1939 Salem | 58 / 96 Fuel distribution |

| 14 | 15 | M Financial Group | Fred Jonske President and CEO | 1978 Portland | 200 / 200 Financial services |

| 15 | 16 | Ron Tonkin Family of Dealerships | Brad Tonkin, Ed Tonkin Co-presidents | 1960 Portland | 955 / 965 Auto sales |

| 16 | 19 | TEC Equipment | David A. Thompson CEO | 1976 Portland | 354 / 992 Auto sales |

| 17 | 17 | R.B. Pamplin Corporation | Dr. Robert B. Pamplin Jr. Chairman, president and CEO | 1957 Portland | 1000 / 4600 Construction |

| 18 | 22 | Consumer Cellular | John Marick CEO | 1995 Portland | 781 / 1108 Telecommunications |

| 19 | 18 | Carson | Lance C. Woodbury CEO | 1957 Portland | 250 / 293 Fuel distribution |

| 20 | NR | Timber Products Company | Joseph H. Gonyea, III CEO | 1918 Springfield | 704 / 1006 Forest products |

| 21 | 23 | Andersen Construction | David Andersen President | 1950 Portland | 264 / 414 Construction |

| 22 | 20 | Deacon Corp. | Steve Deacon CEO | 1981 Portland | 88 / 334 Construction |

| 23 | 21 | Harder Mechanical Contractors | Steve Harder CEO | 1934 Portland | 685 / 1100 Construction |

| 24 | 25 | Farwest Steel Corporation | Pat Eagen President and CEO | 1956 Eugene | 373 / 821 Metals manufacturing |

| 25 | 30 | Tumac | Brad McMurchie Chairman and CEO | 1959 Portland | 80 / 105 Forest products |

| 26 | 24 | R2C Group | Michelle Cardinal, Tim O’Leary Co-founders | 1998 Portland | 117 / 179 Professional services |

| 27 | 26 | Parr Lumber Company | James D. Boyer CEO | 1930 Hillsboro | 506 / 653 Building supplies |

| 28 | 26 | A-dec | Scott Parrish President and CEO | 1964 Newberg | 1015 / 1050 High-tech manufacturing |

| 29 | 31 | Lanphere Enterprises | Robert D. Lanphere Board chair and owner | 1966 Beaverton | 455 / 635 Auto sales |

| 30 | 32 | WSCO Petroleum Corp. | R.W. Dyke CEO | 1970 Portland | 350 / 470 Fuel distribution |

| 31 | 34 | Fortis Construction | Jim Kilpatrick President | 2003 Portland | 140 / 140 Construction |

| 32 | 33 | Shelter Products | Joe Beechler CEO | 1948 Portland | 54 / 93 Building materials |

$150 MILLION TO $250 MILLION

| 2015 RANK | 2014 RANK | COMPANY | SENIOR EXECUTIVE | YEAR ESTAB. CITY | EMPLOYEES: OREGON/TOTAL INDUSTRY |

| 33 | 36 | Harsch Investment Properties | Jordan Schnitzer President | 1950 Portland | 125 / 225 Real estate development |

| 34 | 35 | Columbia Helicopters | Jim Rankin CEO and president | 1957 Aurora | 450 / 700 Air transportation |

| 35 | 43 | Walsh Construction Company | Matt Leeding President | 1961 Portland | 169 / 320 Construction |

| 36 | 49 | Carr Auto Group | Wallace Preble Chairman | 1989 Beaverton | 271 / 331 Auto sales |

| 37 | 37 | Collins | Eric Schooler CEO and president | 1855 Wilsonville | 401 / 687 Forest products |

| TIE 38 | 45 | Capitol Auto Group | R. Scott Casebeer President | 1927 Salem | 248 / 248 Auto sales |

| TIE 38 | 39 | Stoel Rives | Wally Van Valkenburg Portland office managing partner | 1907 Portland | 340 / 782 Legal services |

| 40 | 38 | Plaid Pantries | William C. Girard, Jr. President and CEO | 1963 Beaverton | 750 / 800 Retail |

| 41 | 51 | Dutch Bros. Coffee | Travis Boersma Co-founder and president | 1992 Grants Pass | 1200 / 4000 Retail |

| 42 | 40 | Sherm’s Thunderbird Market | Sherman Olsrud President | 1967 Medford | 615 / 615 Retail |

| 43 | 41 | Jubitz Corporation | Frederick D. Jubitz President and CEO | 1952 Portland | 174 / 196 Fuel distribution |

| 44 | 46 | Tyree Oil | Ronald L. Tyree CEO-President | 1988 Eugene | 70 / 140 Fuel distribution |

| 45 | 42 | Membrane Holdings | Larry Keith CEO | 2007 Lebanon | 332 / 458 High-tech manufacturing |

| 46 | NR | May Trucking Company | C. Marvin May CEO | 1945 Salem | 529 / 1230 Freight transportation |

| 47 | 44 | Leatherman Tool Group | Ben Rivera President | 1983 Portland | 464 / 1564 High-tech manufacturing |

| 48 | 47 | Consolidated Supply Co. | Karla Neupert Hockley President | 1928 Portland | 200 / 350 Building materials |

| 49 | 52 | Willamette Dental Group | Eugene C. Skourtes Chairman, president and CEO | 1970 Hillsboro | 782 / 1296 Health care |

| 50 | 48 | Shari’s Management Corporation | Bruce MacDiarmid President and CEO | 1978 Beaverton | 1600 / 3400 Hospitality |

| 51 | 56 | Wentworth Auto Group | Bob Wentworth, Greg Wentworth Partners | 1903 Portland | 165 / 165 Auto sales |

| 52 | 57 | Bright Wood Corporation | Dallas Stovall President and CEO | 1960 Madras | 840 / 900 Forest products |

| 53 | 54 | Willamette Valley Company | John Harrison President | 1952 Eugene | 125 / 390 Material manufacturing |

| 54 | 53 | Market of Choice | Richard L. Wright Jr. President and CEO | 1988 Eugene | 850 / 850 Retail |

$100 MILLION TO $150 MILLION

| 2015 RANK | 2014 RANK | COMPANY | SENIOR EXECUTIVE | YEAR ESTAB. CITY | EMPLOYEES: OREGON/TOTAL INDUSTRY |

| 55 | 61 | Freres Lumber Co. | Robert Freres Chairman and CEO | 1922 Lyons | 450 / 450 Forest products |

| 56 | 72 | Morrow Equipment Company | Christian Chalupny President | 1968 Salem | 61 / 331 Industrial equipment |

| 57 | 55 | David Evans and Associates | Al A. Barkouli Chairman and CEO | 1976 Portland | 305 / 863 Consulting services |

| 58 | 59 | ZGF Architects | Jan Carl Willemse Managing partner | 1942 Portland | 228 / 510 Professional services |

| 59 | 67 | Royal Moore Auto Center | Royal Moore II President | 1967 Hillsboro | 150 / 158 Auto sales |

| 60 | 60 | Combined Transport | Michael S. Card President | 1980 Central Point | 270 / 586 Building supplies |

| 61 | 69 | R&H Construction | John Bradley CEO | 1979 Portland | 215 / 215 Construction |

| 62 | 62 | Touchmark | Werner G. Nistler Jr. CEO | 1980 Beaverton | 170 / 1650 Real estate development |

| 63 | 73 | Viewpoint Construction Software | Jay Haladay CEO | 1976 Portland | 228 / 464 Software |

| 64 | 65 | Sunset Porsche Audi | Rob Roseta Managing partner | 1980 Beaverton | 135 / 135 Auto sales |

| 65 | 79 | Bookbyte.com | Bryan Hockett Director | 1999 Salem | 137 / 137 Retail |

| 66 | 68 | Guaranty RV | Herbert N. Nill Owner and dealer | 1967 Junction City | 252 / 252 Auto sales |

| 67 | 71 | NAVEX Global | Bob Conlin President and CEO | 1999 Lake Oswego | 189 / 465 Technology |

| 68 | 70 | Landmark Ford Lincoln | Jim Corliss President | 1979 Tigard | 201 / 203 Auto sales |

$75 MILLION TO $100 MILLION

| 2015 RANK | 2014 RANK | COMPANY | SENIOR EXECUTIVE | YEAR ESTAB. CITY | EMPLOYEES: OREGON/TOTAL INDUSTRY |

| 69 | 78 | Deschutes Brewery | Gary Fish CEO | 1988 Bend | 410 / 472 Food processing |

| 70 | 74 | Northwest Pump & Equipment Co. | Gregg Miller President | 1959 Portland | 147 / 302 Industrial equipment |

| 71 | 75 | Rodda Paint Co. | Bill Boone President and COO | 1932 Portland | 180 / 400 Manufacturing |

| 72 | 82 | Weston KIA-Buick-GMC | Jay B. Weston CEO | 1975 Gresham | 114 / 114 Auto sales |

| 73 | NR | Adroit Construction | Steve Lawrence, Bob Mayers Owners | 1979 Ashland | 110 / 110 Construction |

| 74 | NR | Structured | Ron Fowler President and CEO | 1992 Clackamas | 70 / 121 Information technology |

| 75 | NR | Dave’s Killer Bread | John Tucker CEO | 1955 Milwaukie | 287 / 296 Food processing |

| 76 | 77 | LCG Pence Construction | Terry Loerke, Paul Schulz, Dave Hays Owners | 1949 Portland | 60 / 60 Construction |

| 77 | 75 | McDonald Wholesale Co. | Gary Thomsen President and CEO | 1928 Eugene | 124 / 125 Wholesale distribution |

| 78 | 80 | Walter E. Nelson Company | Michael E. Nelson CEO | 1954 Portland | 350 / 440 Paper and packaging |

| 79 | NR | Webtrends | Joe Davis CEO | 1993 Portland | 178 / 325 Technology |

| 80 | NR | Perlo Construction | Jeff Perala, Gayland Looney Owners | 2010 Portland | 108 / 139 Construction |

| 81 | NR | Charter Mechanical Contractors | Dan Smith President | 2006 Portland | 210 / 210 Engineering |

| 82 | 81 | Oregon Canadian Forest Products | Wayne Holm Chairman | 1977 North Plains | 125 / 170 Forest products |

| 83 | 90 | Independent Dispatch | Gregory Gilbert President | 1980 Portland | 72 / 76 Freight transportation services and trucking |

| 84 | 89 | The Portland Clinic | J. Michael Schwab CEO | 1921 Portland | 512 / 512 Health care |

$50 MILLION TO $75 MILLION

| 2015 RANK | 2014 RANK | COMPANY | SENIOR EXECUTIVE | YEAR ESTAB. CITY | EMPLOYEES: OREGON/TOTAL INDUSTRY |

| 85 | 88 | Rogers Machinery Company | George M. Schmeltzer President and CEO | 1949 Portland | 111 / 221 Industrial equipment |

| 86 | 92 | Earl & Brown | Chuck Taylor President and CEO | 1967 Beaverton | 35 / 37 Retail |

| 87 | 98 | Genesis Financial Solutions | Bruce Weinstein President and CEO | 2001 Beaverton | 211 / 213 Finance |

| 88 | 87 | Schwabe, Williamson & Wyatt | David F. Bartz Jr. President | 1892 Portland | 240 / 322 Legal services |

| 89 | 91 | Sherman Bros Trucking | Bart Sherman CEO and president | 1970 Harrisburg | 152 / 369 Freight transportation |

| 90 | 93 | Alpenrose Dairy | Carl Cadonau Jr. Co-president | 1916 Portland | 126 / 126 Food processing |

| 91 | 95 | Miller Paint Co. | Steve Dearborn President/CEO | 1890 Portland | 238 / 353 Retail |

| 92 | 97 | Patrick Lumber Company | Dave Halsey President | 1915 Portland | 24 / 24 Forest products |

| 93 | 83 | Gorilla Capital | John Helmick CEO | 2006 Eugene | 18 / 29 Real estate |

| 94 | 104 | Butler Automotive Group | Charles Butler Jr. President | 1976 Ashland | 98 / 98 Auto sales |

| 95 | 98 | CompView | Scott Birdsall President and CEO | 1987 Beaverton | 75 / 150 Business services |

| 96 | 102 | Cascade Wood Products | Gary Moore President | 1953 White City | 289 / 426 Forest products |

| 97 | 125 | Todd Construction | Brent Schafer President | 1986 Tualatin | 50 / 50 Construction |

| 98 | NR | foodguys | Mark Nyman President | 1991 Wilsonville | 28 / 28 Food distributor |

| 99 | 103 | Vernier Software & Technology | David Vernier CEO | 1981 Beaverton | 101 / 102 Software |

| 100 | NR | John Hyland Construction Co. | Shaun Hyland President | 1978 Springfield | 40 / 40 Construction |

| 101 | 85 | Omega Morgan | Greg Tansey CEO | 1991 Hillsboro | 150 / 190 Freight transportation |

| 102 | NR | Lone Rock Resources | Toby Luther President and CEO | 1950 Roseburg | 96 / 96 Forest products |

| 103 | 64 | Arbor Custom Homes | Dennis Sackhoff President | 1988 Beaverton | 30 / 30 Real estate development |

| 104 | NR | Sunriver Resort | Tom O’Shea Managing director | 1993 Sunriver | 550 / 550 Tourism |

| 105 | 101 | Allied Systems Company | Lewis A. Rink CEO | 1976 Sherwood | 303 / 313 Industrial equipment |

LESS THAN $50 MILLION

| 2015 RANK | 2014 RANK | COMPANY | SENIOR EXECUTIVE | YEAR ESTAB. CITY | EMPLOYEES: OREGON/TOTAL INDUSTRY |

| 106 | 122 | Elemental Technologies | Sam Blackman CEO | 2006 Portland | 147 / 209 Software |

| 107 | 110 | Emerick Construction Co. | Corey Lohman President | 1943 Happy Valley | 45 / 45 Construction |

| 108 | 107 | Miller Nash Graham & Dunn | Dennie Rawlinson Firm chair | 1873 Portland | 171 / 231 Professional services |

| 109 | 110 | Stash Tea | Tom Lisicki President | 1972 Tigard | 75 / 300 Food processing |

| TIE 110 | 118 | Benchmade Knife Company | Lester de Asis Founder and CEO | 1990 Oregon City | 200 / 200 High-tech manufacturing |

| TIE 110 | 107 | Turf Merchants | Steven P. Tubbs CEO | 1983 Tangent | 9 / 9 Grass seed |

| 112 | 109 | Windermere Stellar | Brian Allen President and co-owner | 1972 Portland | 44 / 49 Real estate |

| 113 | 117 | VanderHouwen & Associates | Kathy VanderHouwen CEO | 1987 Portland | 239 / 316 Professional services |

| 114 | 121 | Triplett Wellman | Gene Wellman Principal | 1982 Woodburn | 39 / 39 Construction |

| 115 | NR | Hasson Company Realtors | Lynae Forbes President | 1983 Lake Oswego | 23 / 25 Real estate |

| 116 | 119 | Northside Ford Truck Sales | Jim McDonough President | 1972 Portland | 68 / 69 Auto sales |

| 117 | 125 | Chambers Construction | David Hilles President and CEO | 1955 Eugene | 85 / 85 Construction |

| 118 | 127 | Ochoco Lumber Co. | Bruce Daucsavage President | 1927 Prineville | 112 / 113 Forest products |

| 119 | 120 | Far West Recycling | Keith Ristau President and CEO | 1980 Portland | 81 / 82 Paper and packaging |

| 120 | 115 | Rexius Forest By-Products | Arlen Rexius Co-president | 1935 Eugene | 300 / 300 Forest products |

| 121 | NR | First Call Resolution | John Stadter CEO | 2008 Roseburg | 1290 / 2005 Business services |

| 122 | 123 | Smarsh | Stephen D. Marsh CEO | 2001 Portland | 120 / 215 Software |

| 123 | 113 | P&C Construction | Steve Malany President | 1961 Portland | 35 / 35 Construction |

| 124 | 124 | Otak | James Hamann CEO | 1981 Portland | 82 / 199 Professional services |

| 125 | 129 | Olsson Industrial Electric | Ike Olsson President | 1982 Springfield | 100 / 130 Construction |

| 126 | NR | Directors Mortgage | Mark J. Hanna Chairman and CEO | 1998 Lake Oswego | 125 / 168 Financial services |

| 127 | 132 | Neil Kelly Company | Tom Kelly Owner and president | 1947 Portland | 165 / 199 Construction |

| 128 | 135 | G5 | Dan Hobin CEO | 2005 Bend | 148 / 155 Software |

| 129 | 134 | Yorke & Curtis | Erik Timmons Principal | 1988 Beaverton | 30 / 30 Construction |

| 130 | 133 | Beaverton Foods | Domonic Biggi CEO | 1929 Hillsboro | 72 / 68 Food processing |

| 131 | NR | Lile International Companies | Diane DeAutremont President | 1959 Tigard | 194 / 333 Transportation |

| 132 | 136 | General Sheet Metal | Carol Duncan President | 1932 Clackamas | 93 / 93 Construction |

| 133 | 137 | Portland Bottling Company | Tom Keenan President | 1924 Portland | 76 / 76 Food processing |

| 134 | 139 | iovation | Greg Pierson CEO and founder | 2004 Portland | 83 / 94 Software |

| 135 | 131 | Bullivant Houser Bailey | Loren Podwill President | 1938 Portland | 75 / 115 Legal services |

| 136 | 138 | The Partners Group | Roderick B. Cruickshank President and CEO | 1999 Portland | 72 / 119 Professional services |

| 137 | 143 | Madden Industrial Craftsmen | Ron Madden President | 1988 Beaverton | 36 / 36 Professional services |

| 138 | NR | Plexis Healthcare Systems | Jorge Yant President and CEO | 1996 Ashland | 67 / 79 Technology |

| 139 | NR | SERA Architects | Donald Eggleston Principal and president | 1968 Portland | 110 / 110 Architecture |

| 140 | 144 | ACME Business Consulting | David Kelleher Principal | 2002 Portland | 64 / 81 Professional services |

| 141 | 142 | MyBinding.com | Mike Ware Principal | 1998 HIllsboro | 70 / 75 Retail |

| 142 | 147 | Ruby Receptionists | Jill Nelson CEO | 2003 Portland | 197 / 197 Professional services |

| 143 | 145 | Café Yumm! | Mark S. Beauchamp President | 1997 Eugene | 254 / 269 Hospitality |

| 144 | NR | Centrex Construction | Jimmy Severson Director of business operations | 1978 Portland | 14 / 14 Construction |

| 145 | 148 | Connective DX | Paul Williams President | 1997 Portland | 60 / 82 Professional services |

| TIE 146 | NR | CorSource Technology Group | Andrew Hermann President | 2004 Portland | 95 / 95 Software |

| TIE 146 | NR | KPD Insurance | Kyle Hudson CEO | 1979 Springfield | 72 / 72 Financial services |

| 148 | NR | EdgeLink | Mike Miadich Owner | 2003 Portland | 18 / 33 Staffing |

| 149 | NR | PREM Group | Jacob Johnson CEO | 1993 Portland | 65 / 65 Property managment |

| 150 | NR | All American Specialty Restaurants | C. R. Duffie, Jr. President | 1986 Portland | 28 / 28 Restaurants / hospitality |