Unlike NCAA hoops, market volatility is the norm and is not considered an upset.

March Madness turned to March Mayhem in the NCAA basketball tournament.

While upsets happen in the first round, there seemed to be more then usual.

Also, basketball viewers witnessed what some have called the biggest upset in sports history, or at least since the Miracle on Ice in 1980, when the University of Maryland Baltimore County beat tournament favorite Virginia. This was the first time in history that a number 16 seed beat a number one seed.

The volatility we’ve seen in the basketball tournament is being played out in the equity markets as well. The difference is that, unlike NCAA hoops, this market volatility is the norm and is not considered an upset.

The chart below highlights that we are indeed back to normal volatility, which has been at historic lows, particularly in 2017.

The heightened sense of angst started at the beginning of February with concerns over inflation; specifically, wage growth was a little too hot.

The heightened sense of angst started at the beginning of February with concerns over inflation; specifically, wage growth was a little too hot.

That infamous data point from the jobs report on February 2 led to a 10% plus selloff in equities in the month. The volatility has remained due to concerns over tariffs and trade. The selloff we experienced is the norm, not an anomaly. The chart below highlights that on any given year, stocks are going to pull back 13 percent and recover those gains in six months as investors become worried about “something.” This is just a normal correction. If we are not heading into recession, then these selloffs should be short-lived, and not deep as the chart shows for the onset of a bear market.

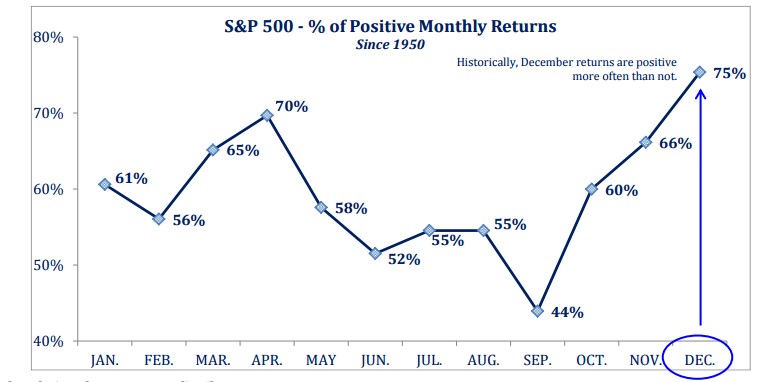

Markets always worry … and rightfully so. We are in the 10th year of a bull market and while there are a lot of risks at present, we believe that stocks will continue to climb the “wall of worry” and drive prices higher.

Markets always worry … and rightfully so. We are in the 10th year of a bull market and while there are a lot of risks at present, we believe that stocks will continue to climb the “wall of worry” and drive prices higher.

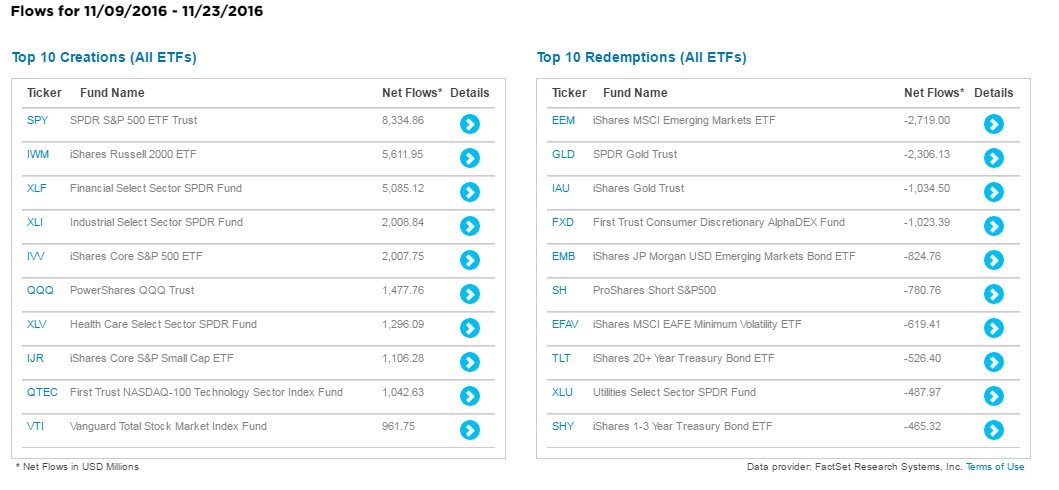

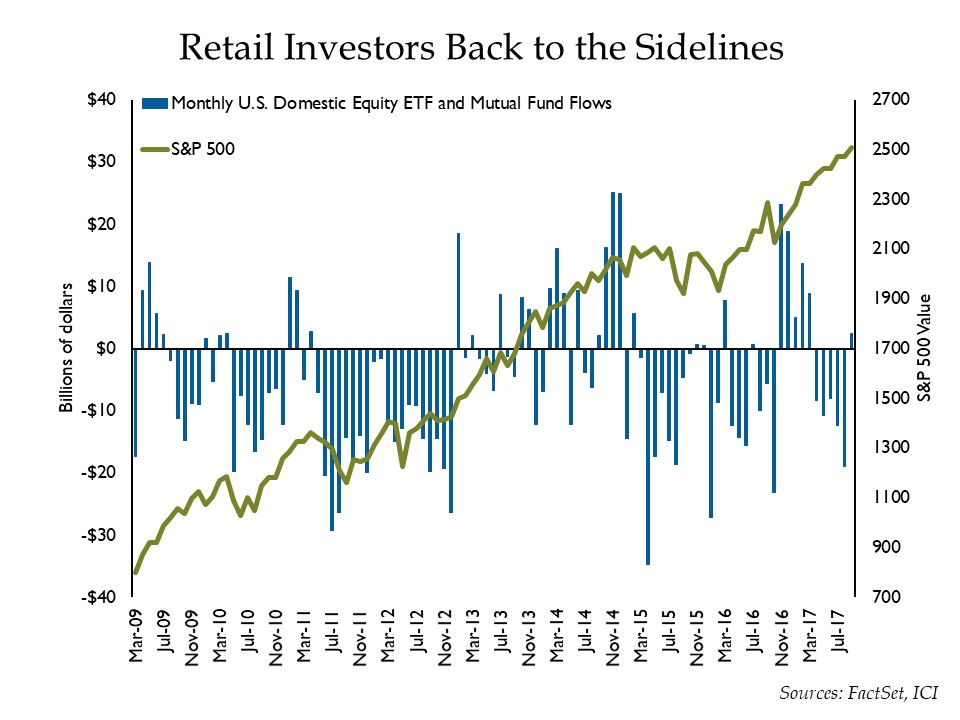

Stock strength in 2017 finally caught the attention of retail investors. The last nine months of the year showed investors selling their domestic equity funds and ETFs, even in the face of a strong market. This changed in January and then reversed in February and March when retail investors sold $54 billion of U.S. equity funds and ETFs.

Investors are still gun shy after nine years of strength. As Kenny Rogers famously wrote, “You have to know when to hold ‘em, and know when to fold ‘em.” Unfortunately, the average investor has been regularly “folding,” even when the hand was strong.

Investors are still gun shy after nine years of strength. As Kenny Rogers famously wrote, “You have to know when to hold ‘em, and know when to fold ‘em.” Unfortunately, the average investor has been regularly “folding,” even when the hand was strong.

The Coin Flip: From the global economy to what’s happening here in Oregon

Oregon Saves goes live in April for employers.

This plan allows workers to contribute, via a payroll deduction, to their own personal Roth IRA.

The goal is to encourage more retirement savings by workers. While the spirit of trying to help workers plan for retirement is commendable, its important to compare the state’s fees to other options.

If an individual opened up a Roth IRA and set up automatic investments, individuals may be able save money by not paying the administration fee charged by the state.

For some, having the savings come straight from their paycheck is the best way to ensure participation. We believe retirement savings is imperative and should be started as early as possible. Different plans will work for different people and their unique circumstances situations, but the key is ensuring participation.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management.