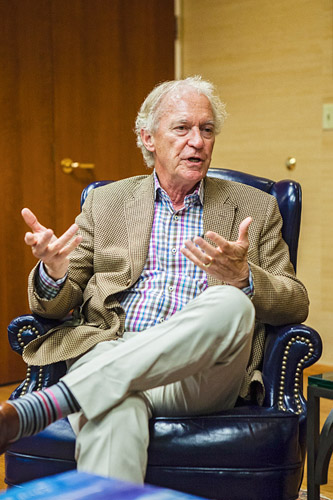

PHOTOS BY JASON E. KAPLAN

On a recent Thursday afternoon, Bill Furman was in his Lake Oswego office explaining how the laws of physics are driving change in the railcar industry.

The North American energy boom has put pressure on railroads to transport oil safely and quickly, says the CEO of The Greenbrier Companies, a barge and railcar manufacturer and lessor. “Regrettably, at high speeds, the existing cars develop [destructive energy] in that velocity, and that increases in a very steep slope according to the formula: mass divided by two times velocity squared.

“So what you need is a stronger railcar that is appropriate for the times.”

Oil is gushing out of the U.S. and Canada, and much of it is coming from places that don’t have pipeline infrastructure. So it’s being shipped by rail. In 2008, around 9,500 carloads of crude oil were transported by rail in the U.S. By 2013, that number topped 400,000, according to the Association of American Railroads.

That’s good news for the railroad and railcar business. But not all the attention has been positive. A series of oil train derailment disasters, including one that killed 47 people in Quebec last summer, has raised awareness of the hazards associated with transporting flammable fuels by rail. The tragedies have fueled public opposition to oil trains and a spate of proposed fossil fuel export terminals.

A former smoke jumper who founded Greenbrier in 1973, Furman aims to take control of the narrative. The company this past winter released a new, stronger tank car design — “the tank car of the future” — intended to reduce the probablility of an explosion in the event of a derailment. The beefed up car puts Greenbrier “on the side of the angels,” Furman says. It also puts Greenbrier in a position to reap huge financial benefits — after anticipated federal standards mandating safer railcars go into effect, possibly next year.

“The energy boom will be huge for our company because it will end up having a safety halo effect on all railcars,” Furman says.

With his rumpled hair and meandering speaking style, Furman comes across as an absentminded if opinionated professor. He is known for venting about Portland’s business climate and on this day describes his corporate strategy in context of a grand geopolitical vision, in which railroads serve as a critical transportation link connecting fossil fuels, domestic manufacturing and renewable energy — “putting us on a path that will help the world, help democracy and help the U.S. retain its economic footing.”

For now, Greenbrier, one of Oregon’s largest public companies, is riding the petroleum wave. In the third quarter of 2014, Greenbrier saw revenues of $593.3 million, up from $433.7 million last year. Its stock has tripled in the past year. Since June the company has received orders for 15,000 rail cars, valued at $1.5 billion.

To meet demand, Greenbrier is doubling its capacity to build new cars, including recently replacing a leased assembly facility in Mexico with a larger owned facility. The company, which employs 1,000 at its Gunderson plant in Portland, is also bullish on automotive cars and is diversifying with a new plastic-pellet car, “which we think will be huge,” says Furman. “Downstream derivative products are returning to America because of cheaper natural gas, propane and butane.”

Other things are driving up Greenbrier’s stock price, says Furman. He points to a new strategic plan the company adopted following a takeover attempt in 2012 by Carl Icahn, the activist investor and chairman of American Railcar Industries. “Carl Icahn is a good friend,” Furman observes. “He just believes friends stab you in the front.” Furman says the plan includes “our newfound zeal for transparent communications,” such as improving communications with investors and breaking down operating margins by segment.

Other things are driving up Greenbrier’s stock price, says Furman. He points to a new strategic plan the company adopted following a takeover attempt in 2012 by Carl Icahn, the activist investor and chairman of American Railcar Industries. “Carl Icahn is a good friend,” Furman observes. “He just believes friends stab you in the front.” Furman says the plan includes “our newfound zeal for transparent communications,” such as improving communications with investors and breaking down operating margins by segment.

About that safety push: Greenbrier, which manages 235,000 cars and leases more than 8,000, hopes to turn aggressive advocacy for safer railcars into a growth opportunity. The company has already received 3,500 awards for the new tank car and is leading the charge in Washington D.C. in support of new safety standards. To service the new tank car fleet, Greenbrier in July formed a joint venture with Watco Companies featuring 38 repair and refurbishment sites across the country.

The push to fast track safety has put Greenbrier at odds with some of the companies whose fuels it transports, Furman says. “Big oil would prefer stability and probably prefer that we change more slowly.”

But Furman is in the transportation equipment business not the oil business — and if he’s making a mint off the fossil fuel industry, he’s also hedging his bets on a clean energy future. Furman dismisses Portland opposition to coal export terminals as “silliness and a form of Ludditism.” But he also criticizes U.S. involvement in Russia and the Middle East — “why do we have to be the world’s policeman?” — and champions a higher gas tax, 50 mph fuel-efficiency standards and a transportation policy that gets trucks — “they’re pounding our pavement to pieces” — off the highways.

“Why wouldn’t we do those things?” Furman asks. “Because huge interests have an investment in not doing that.”

In the long term, the oil boom will accelerate interest in alternative fuels, says Furman, noting that hydraulic fracturing methods used to extract oil and natural gas are giving new life to renewable energy technologies like fuel cells. Efficient and reliable —”like a steamship that goes back and forth across the country” — railroads are a natural fit for this emerging sustainable economy, he says. “We’d like to be a bridge to the future.”

Until then: “We are judicious about the battles we take on and we usually win: Icahn and in this case advocating for safer rail cars,” says Furman, who describes this part of his career as “one of the more exciting in my life.”

Furman is aware of the irony: Railroads, a gritty, industrial revolution-era business, are a hot item in a 21st-century economy known for software, consumer services and, apparently, the rebooting of the oil age. Now he hopes the company’s safety drive will placate increasingly vocal critics and extend the bonanza.

For Greenbrier, and its CEO, shoring up the nation’s railroads is the ticket to a secure future.

The Greenbrier Companies

CEO | Bill Furman

Headquarters | Lake Oswego

Employees | 12,000 worldwide