BY JASON NORRIS | GUEST BLOGGER

BY JASON NORRIS | GUEST BLOGGER

There are winners and losers with a strengthening U.S. dollar.

BY JASON NORRIS | GUEST BLOGGER

There are winners and losers with a strengthening U.S. dollar

In the first three-and-a-half months of 2015, equity markets have been fairly volatile, resulting in little net gain or loss for U.S. large-cap investors. On the contrary, global investors have enjoyed very healthy returns after several years of lagging their U.S. peers. European investors have been able to achieve returns of over 12 percent1 compared their U.S. counterparts by around 2 percent.

The key to these gains has been the view that Eurozone quantitative easing will work as it has here and those economies with begin to reaccelerate their economic growth engines. Unfortunately, investors outside the U.S. haven’t been able to enjoy those double digit returns even if they were invested in the European markets. This delta has occurred because of the continued strengthening of the U.S. dollar versus the euro. Therefore, when U.S. investors buy European stocks and the dollar strengthens, investors will get fewer dollars back. Thus, we have seen a 7-percent decline in the euro so far this year and that has eaten away at equity returns for U.S. investors. Even after this decline, returns are still besting the U.S. indices.

There are winners and losers with a strengthening U.S. dollar. One main impact for U.S. consumers is that goods imported from other countries are cheaper … this includes vacations.

Travelers were pleased to learn that a hotel in Paris costs roughly $85 less this April than it did last year. This trend should also help to keep inflation low with the prices of goods coming into the U.S. staying lower, longer.

The downside of the strengthening dollar is that it makes U.S. goods more expensive in Europe since consumers have to use more euros to buy the same number of dollars. The risk here is whether U.S. companies reduce prices to compete or hold prices and risk losing sales. We have seen this phenomenon present in the earnings reports of U.S. companies so far this year. This implication will be a headwind for revenue growth for large export-orientated companies.

Down in a Hole

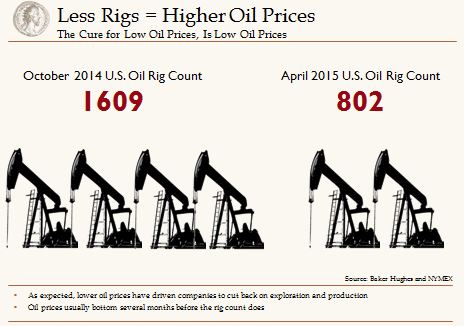

Headwinds to earnings are not just being driven by the strong dollar. The decline in oil prices has put a major dent in the income statements of producers over the last couple quarters. Oil prices ended March in the low-to-mid $40 range, which is more than $60 less than a year ago. This rapid decline has resulted in major cuts in capital spending and energy jobs. We do believe we have seen the low in oil and this is based purely on supply and demand. Demand for energy continues to remain fine; it’s been the issue with supply that has driven prices lower. We continue to closely follow U.S. oil rig counts to monitor supply.

U.S. oil rig count has been cut in half over the last six months and with fewer rigs there is less supply. Oil producers, especially in the U.S., are able to quickly reduce supply due to the types of wells they drill which puts a floor in the price of oil. We continue to believe that the cure for low oil prices is … low oil prices.

Show Me the Money

Before the fall in oil and the rise in the dollar, earnings for the broad, domestic equity market (S&P 500) were forecasted to rise around 10 percent as U.S. growth continued to reaccelerate. The decline in oil prices has resulted in a 7-to-8 percent reduction in profit. The strong dollar has also contributed a 2-to-4 percent reduction as well. This has resulted in forecasted 2015 earnings growth to fall to 2 percent. Therefore, the headlines investors will see in the press shows a major slowdown in profit growth. While that is true, if you exclude the energy sector, which is roughly 10 percent of the market, profit growth is still forecasted to grow just under 10 percent. We believe this shows the underlying economy is still quite healthy.

Both Sides of the Coin

The strong dollar is certainly going to have an impact on Oregon companies and residents. Over 10 percent of Oregon GDP is export-related. According to a recent update from the Oregon Office of Economic Analysis, Portland is ranked as the second most trade-dependent metro area. Export growth has been key to growing higher paying manufacturing jobs as well as employment in general. Employment growth in the state should reach 3.4 percent in the first quarter – the highest level in close to 10 years. However, there are estimates that the strong dollar and global growth slowdown may take 100 bps of growth out of U.S. GDP in the first quarter. These headwinds, as well as the issues at the Port of Portland, may lead to a deceleration in state employment growth over the course of 2015.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.

[1] Equity returns cited in this section are taken from MSCI index data as of April 17, 2015. https://www.msci.com/end-of-day-data-search

BY JASON NORRIS | GUEST BLOGGER

BY JASON NORRIS | GUEST BLOGGER