Tech boom drives stock rally nationally, but Intel doesn’t share the love.

Earlier this month, the S&P 500, Dow Jones Industrials and NASDAQ did something that we haven’t seen since December of 1999; they all closed at all-time highs on the same day. While the Dow and S&P have been subsequently posted numerous new highs, it has taken the tech-heavy NASDAQ over 16 years to eclipse its frothy levels of the late 90s.

Significantly, the NASDAQ has returned to these levels much healthier. For example, in the late 1990s, the index was trading at a price-to-earnings ratio of over 100x, while today it is trading at only 20x. The tech sector is much more profitable today as the companies have moved from focusing just on revenue growth to cashflow generation.

I was fortunate to start in the investment industry during the heyday of the late 1990s. As an equity analyst at a large investment firm on Wall Street, I witnessed the mania at the ground floor.

I was fortunate to start in the investment industry during the heyday of the late 1990s. As an equity analyst at a large investment firm on Wall Street, I witnessed the mania at the ground floor.

It was a time of boondoggle conferences and access to a myriad of initial public offerings (IPOs), be it a worthy investment or not. If pets.com was going to spike on its trading debut, you wanted an allocation. There were a number of great tech companies that emerged out in the late 1990s that received more hype than the fly-by-night ones.

I was struck by a comment made by a portfolio manager I worked with during that time who said, “While all the attention is currently on these tech companies, the real winners are going to be the businesses that are using the technology to be more productive.”

We are seeing this today as companies are able to do more with less, as well as the need for more technical training for employees. Another small company I came across 10 years ago employed 450 people. Today they are enjoying record revenues and employ only 300.

Ten years ago the company’s technology team carried around screwdrivers and wrenches. Today they carry around iPads … and make a lot more money. Technology has revolutionized our economy and has made businesses more efficient, but this is shaping the composition of our workforce.

Former New York City Mayor Bloomberg summed it up in a recent CNBC interview when he stated that that technology is displacing more jobs than global trade. We can see this play out today with the largest companies in the U.S. in the technology sector, not energy or manufacturing. Technology companies that focus on consumer products, media and outsourcing, such as Apple, Alphabet (Google), Facebook and Microsoft, are the market leaders of the 21st century.

The Rodney Dangerfield Market

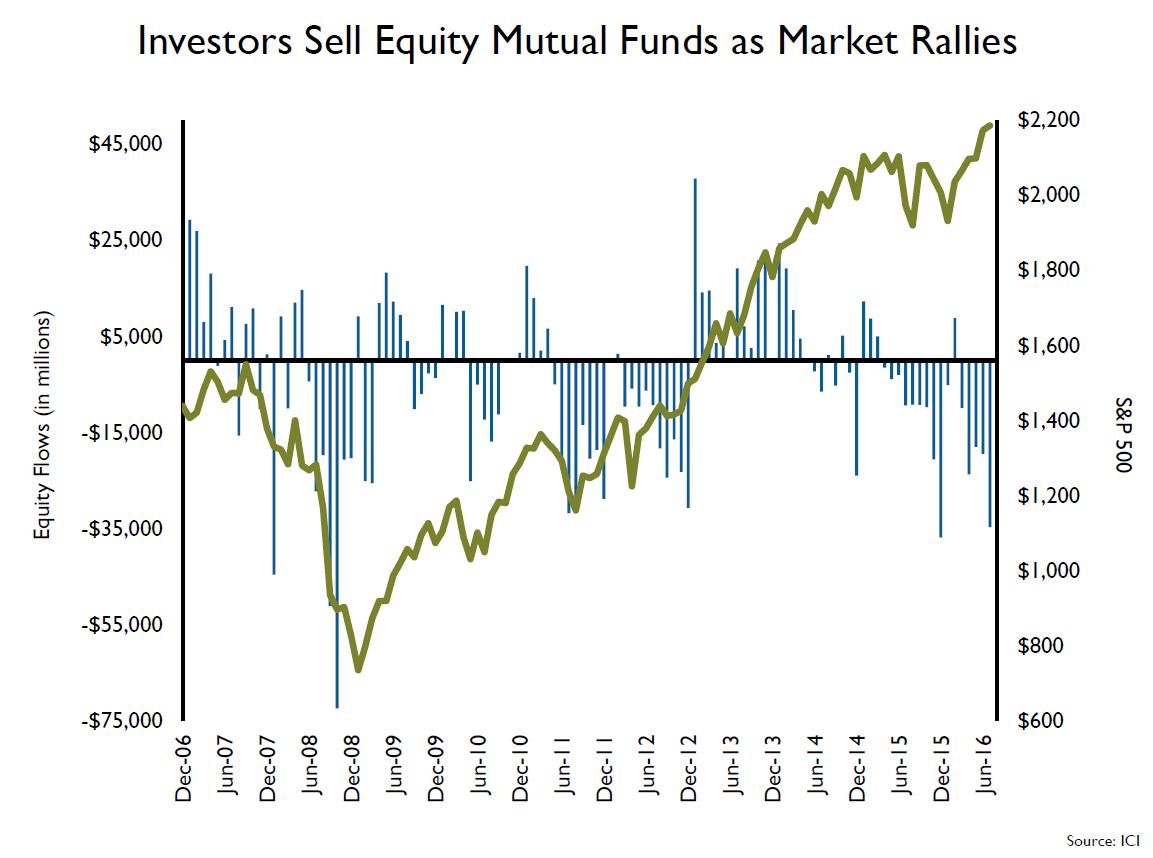

While stocks are sitting at all-time highs, U.S. investors continue to be skeptical. Over the last five years, investors redeemed over $275 billion from their equity funds. That number is deceiving, since over 100 percent of that was U.S. funds. Over the same period, U.S. equity funds saw $580 billion in redemption while international funds saw over $300 billion in new money. The chart below highlights the constant selling of U.S. equity funds.

Selling over this period, however, was not prudent. While international stocks returned just under 10 percent, U.S. large-cap stocks were up over 87 percent. As the late, great Rodney Dangerfield would say, this stock bull market “don’t get no respect.” Even though stocks have had a strong performance interval, with low interest rates and healthy economic growth, we still believe that the equities can move higher.

The Coin Flip: From the global economy to what’s happening here in Oregon

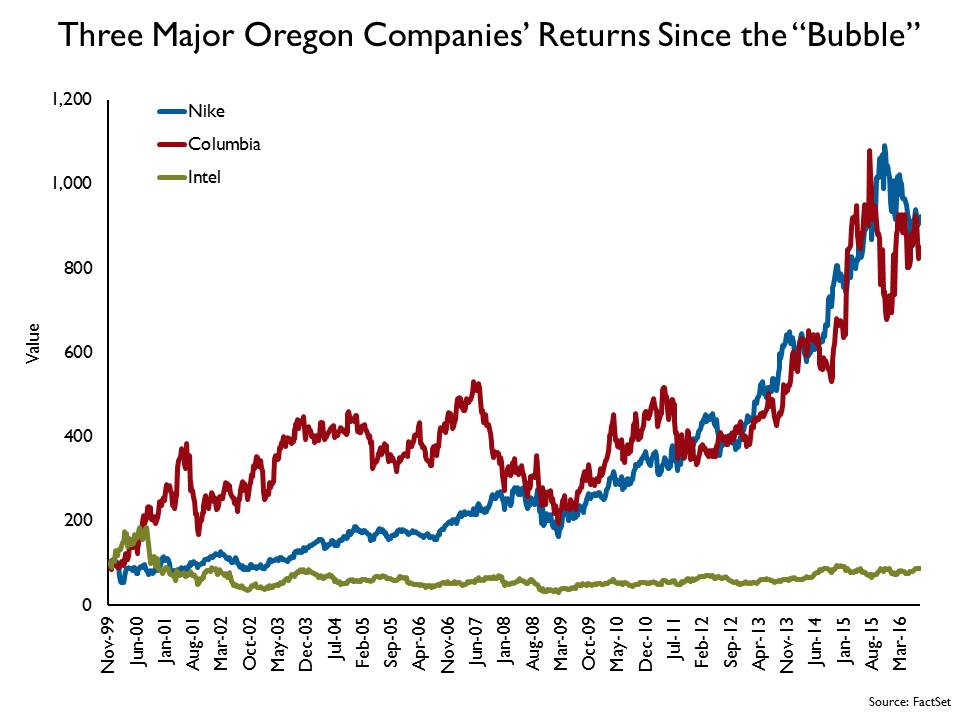

While the NASDAQ just eclipsed its all-time high from 1999, and the S&P 500 is 40 percent above its 1999 levels, three of Oregon’s largest companies have generating vastly different results. While Intel has yet to reach its 1999 levels, both Nike and Columbia Sportswear have meaningfully outpaced the broad markets over the same time period as seen in the chart below. Both Columbia and Nike are up over 900 percent, while Intel is down almost 15 percent.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Norris is a guest blogger on the financial markets for Oregon Business.