After a volatile year, markets have become more resilient and unemployment rates have plummeted.

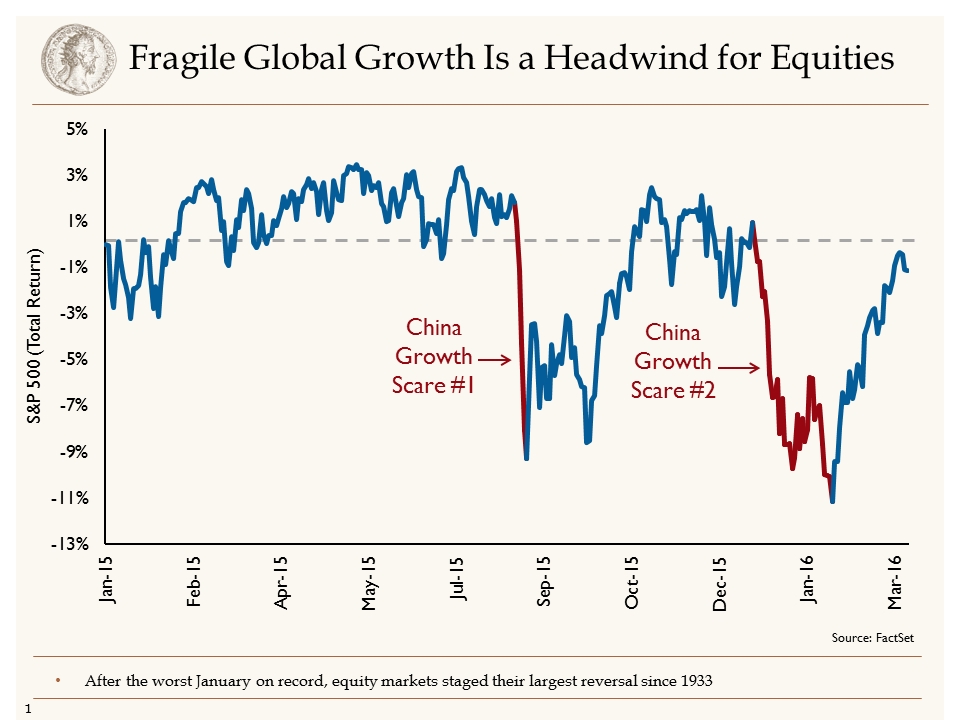

It may be surprising to casual investors that stocks are up over 3 percent this year and the Dow Jones Industrial Average is a just a few hundred points from reaching its all-time high. After the experience investors have had with volatility over the past year, it appears that markets have become more resilient. Looking back to mid-2015 and earlier this year, China was the “elephant in the room” causing fear in the global markets. The chart below highlights to two China “scares” we experienced the last 12 months.

Both of these events were triggered by announcements regarding the devaluation of the Chinese yuan. Although these adjustments were relatively small, they spooked investors, nonetheless.

We have been adamant that the Chinese economy would not slip into recession and their transition from an investment-focused economy to a consumer-led economy may be bumpy, but necessary. This transition has pressured commodity prices and strengthened the U.S. dollar, which were both headwinds for profit growth last year.

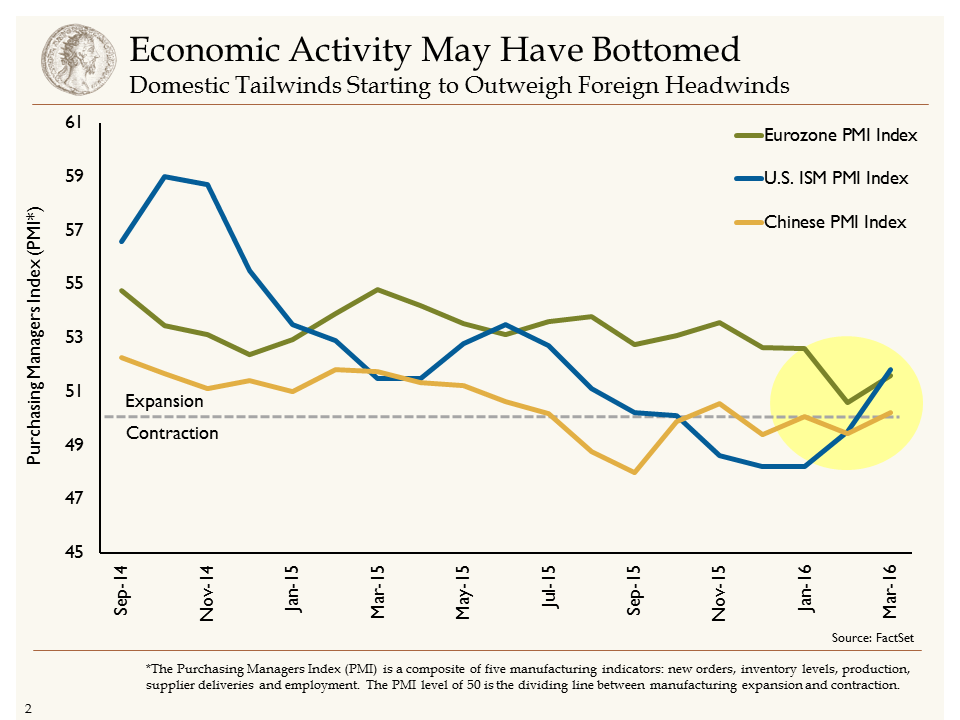

Our focus over the last two years has been our positive outlook for the U.S. economy. 2015 was a difficult year for classic manufacturing and industrials primarily due to a tough export market and falling energy prices. Fast forward to 2016, we believe that global manufacturing is showing signs of improvement. The chart below highlights the purchasing managers index (PMI) from the U.S., China and the Eurozone. The PMI essentially takes the temperature of the manufacturing sector by analyzing new orders, inventory levels, production, supplier deliveries and employment. Purchasing managers across the globe are surveyed and an index is above 50 is considered a positive sign for the economy.

As seen above, the three major regions of the global economy have shown improvement in manufacturing. This pickup in global growth has resulted in a weakening of the U.S. dollar, which is also a positive development for U.S. manufacturers.

With an improvement in U.S. manufacturing, we believe the GDP growth will continue to trend around 2 percent. The consumer component of our economy is healthy with unemployment at multiyear lows, and consumers paying down their debt from their excesses of the last decade. Incomes are rising and we expect the new frugal consumer to increase spending as they have replenished savings.

What does this mean for investors? First, corporate profits will reaccelerate in 2016 from flat growth. Second, the Fed most likely will raise rates just a few times because while the economy very good right now, it’s not what the Fed would view as “off the charts.” This will result in mid to high single-digit returns for equities and low single-digit returns for bonds.

The Coin Flip

From the global economy to what’s happening here in Oregon

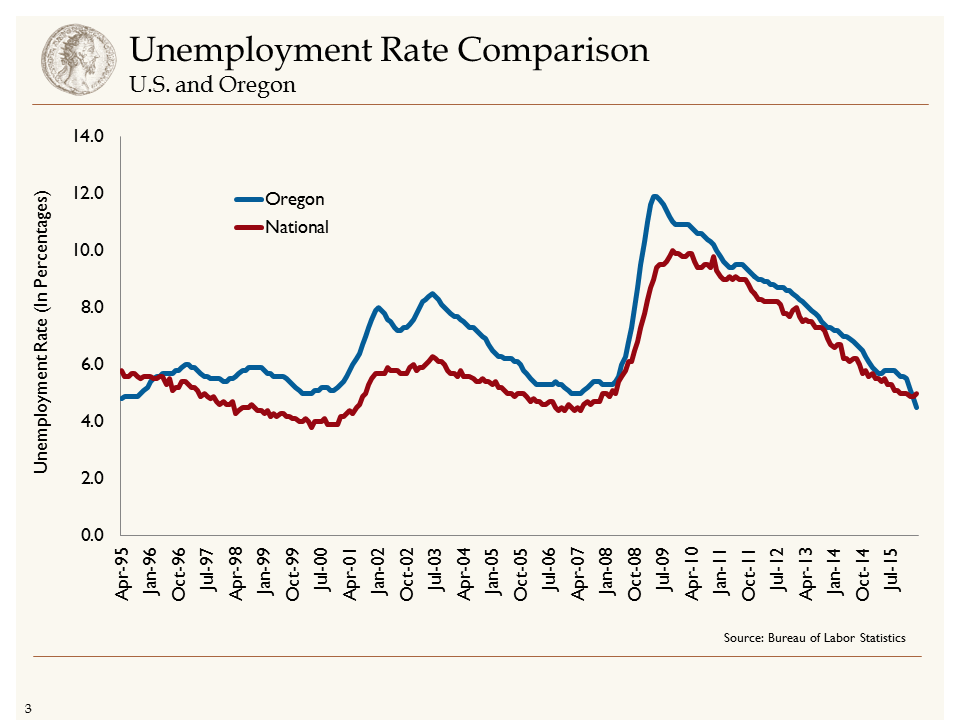

While the U.S. unemployment has fallen from to 10 percent to 5 percent, remarkably, Oregon has participated in this improvement even more so. The graph below highlights over 20 years of unemployment rate data and the clear takeaway is that Oregon has been consistently worse than the U.S. up until the last couple months. Oregon’s rate is sitting at 4.5 percent and is the lowest we’ve seen over this period of time.

We believe we are seeing this positive trend in the housing market, which (un)fortunately is starting to see strong upward pricing pressure. This is also pressuring the rental market as well. While policymakers have good intentions to cap rental increases to maintain affordable housing, this may lead to reduced supply and inevitably result in a shortage of affordable housing.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.