BY JASON NORRIS | OB GUEST CONTRIBUTOR

BY JASON NORRIS | OB GUEST CONTRIBUTOR

“Sell in May and go away.” This classic Wall Street saying seems to be prevalent these days as equities muddle along and bonds continue to rally.

BY JASON NORRIS | OB GUEST CONTRIBUTOR

BY JASON NORRIS | OB GUEST CONTRIBUTOR

Sell in May and Go Away?

This classic Wall Street saying seems to be prevalent these days as equities muddle along and bonds continue to rally. The yield on the 10-year Treasury fell below 2.5% earlier this month as investors attempt to seek safety and income. Economic data hasn’t been great, but then again it really hasn’t been bad. We believe that as summer comes to fruition, stocks will outperform bonds in 2014.

Global Bond Investors Migrating West

As investors increase their exposure to bonds, driving the yield on the 10-year Treasury below 2.5%, it leaves us curious as to what is motivating this behavior. One culprit may be that U.S. yields are relatively high on a global basis. Fixed income investors have many markets to consider, but it seems the U.S. continues to be very attractive. Yields in Germany on 10-year government debt are as low as 1.3%, whereas France isn’t much higher at 1.8%. There is relatively no income in Japan, with yields under 0.6%. Therefore, the U.S. is competing more with Norway (2.6%) and even Spain and Italy (both around 3%). It is no wonder with global rates so low that investors are flocking to the U.S. to boost their coupon.

Pleasantly Surprised

We saw mixed data from the consumer in the month of May. Retail sales came in with a disappointing 0.1% monthly gain, with autos being a drag. Walmart disappointed investors as higher gas prices and lower government assistance programs pulled down spending. Nordstrom, on the other hand, exhibited strong growth in their market segments. Jobless claims hit a 7-year low with initial applications for benefits dropping 24,000 from to 297,000 earlier this month and small business sentiment at a 6-year high. We believe the U.S. economy is improving after a poor first quarter, primarily due to weather, and we remain bullish on increasing domestic growth. Cisco Systems reiterated this view on their most recent earnings call, citing April as a “very good month” with the U.S. leading the way in growth.

Overall, first quarter earnings season ended better than expected. Analysts were anticipating first quarter profits for the S&P 500 to decline slightly; however, the result was 4 to 5% growth with the majority of companies reported. Commentary has been consistent with what Cisco said, that March and April were showing improvements over January and February.

Back to the Future

The housing market has been gradually improving with low mortgage rates and a better employment picture. It hasn’t had its fits-and-starts, primarily due to tight supply in key markets, as well as a recent increase in interest rates. We believe that housing will continue to contribute to U.S. GDP growth; however, it will not improve in a straight line. This uneven recovery hasn’t been lost on Washington, D.C. Earlier it was reported that several agencies are proposing new rules that would loosen requirements for mortgages. The chart below shows that home ownership has dropped from 69% to just under 66%.

It seems as if there is a short memory in D.C. due to the fact that lax mortgage requirements were a key contributor to the housing bubble and subsequent crash. Home ownership has always been part of the “American Dream;” however, it is a slippery slope to ease requirements which may result in another rash of foreclosures as the Federal government attempts to put families into homes (and mortgages/debt) which they may not have the means to service. Can you say, “Deja vu?”

The Highest of the Lows

Global hedge fund data was released earlier this month. For the first time since this data was recorded back in 2003, hedge funds have lost money for three consecutive months while equity markets rose. It seems that a considerable number of hedge funds have been long small-cap growth and as we’ve seen that trade unwind rather quickly, they have been slow to follow. Time will tell if this is a short-term phenomenon or a longer-term trend. There have been parts of that market that moved into “bubble territory;” however, we believe that this is just a narrow slice. Our small-cap exposure tilts toward “value” and we still believe this area of the market is attractive due to its exposure to the U.S. economy.

This wasn’t the only headlines relating to hedge funds; Las Vegas was the location of an annual alternatives investment conference earlier this month. Headlines were made when Hedge Fund Manager David Tepper made cautious comments regarding U.S. equity markets. These made headlines on CNBC and other financial press, prompting speculation that this “news” was one of the causes of the 167-point decline on the Dow on May 15. If you look under the hood, Mr. Tepper’s comments weren’t as bearish as market participants interpreted them. He stated he was still invested in equities, but had simply increased his cash allocation a bit. When an obscure hedge fund manager can move the market to the downside, it does highlight the skittishness in the markets now.

After multiple positive years for equities, it is not surprising that investors are reducing their exposure; however, we believe that when economic growth becomes evident, investors will reallocate back to equities and the markets will continue to grind higher.

What Does “Sell in May and Go Away” Mean?

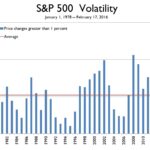

For some it’s a phrase. For others it’s an investment strategy. Regardless, the saying is derived from the historical occurrence whereby from May to October, stocks underperform relative to November to April. Although the data supports this theory, many investors may not realize that the S&P 500 can still be positive over this period, just less so. Therefore, if investors choose to follow this mantra, they would still have to find investments that generate a positive return. The returns generated from November to April are roughly 7% and from May to October roughly 0.5%. The main culprit is the month of September, which is down over 1% by itself. We are not sure if this adage will play out this year. Looking at the previous six months ending April 30, 2014, the S&P 500 was up 8%. Also called the “Halloween Indicator,” we have yet to see if investors will be ‘spooked’ by this saying … or phenomenon.

Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman analysts blog on the financial markets for Oregon Business.

BY JASON NORRIS | OB GUEST CONTRIBUTOR

BY JASON NORRIS | OB GUEST CONTRIBUTOR