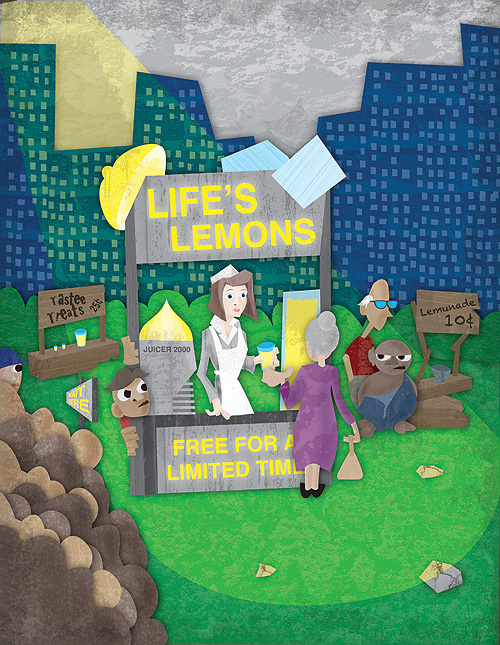

Need cheap technology or want to buy a business? The sweet deals pile up as the downturn drags on.

STORY BY BEN JACKLET // ILLUSTRATIONS BY NICK GILLETT

The recession officially ended 18 months ago, in June 2009. But it sure doesn’t feel that way in Oregon. The job market is weak, the real estate market is in deep trouble, the foreclosure mess is far from cleaned up, banks are still wobbly and consumer confidence is understandably low.

But there are opportunities in this economy for those fortunate enough to be in a position to invest. Big opportunities. The housing market doesn’t look so bad if you are a buyer. Neither do the markets for businesses, land and technology upgrades. Even as the slump drags on in painful ways for some Oregon companies, others are exploring new markets with great long-term promise. “I’m more optimistic than I have been in years,” says Portland-based financial consultant Larry Willeman of Willeman Strategic Partners, who coaches CEOs on managing cash flow and investing strategically. “I’m seeing opportunities everywhere.”

There is no disputing that most Oregon businesses continue to wait for the sort of recovery that can bring the confidence to invest. But for those with the ability and mindset to find and exploit opportunities, it is a time ripe with possibility. Paradoxically, the more people who seize these opportunities, the faster they will start to vanish, replaced by new demand and competition, and the sooner true recovery will arrive.

But until that happens, here are five areas where opportunity is knocking and Oregon companies are answering the call.

The real estate landscape is littered with deals

Barry Menashe likes to say he started out in the real estate business 35 years ago with 25 cents in his pocket. Now he owns more properties than he can name. In September he bought the historic Police Headquarters building in downtown Portland for $2.5 million, half of what it sold for 10 years ago and less than a third of the boom-time asking price. As always, he moved quickly and paid cash.

“Is that a beauty or what?” Menashe asks as he strides purposefully across a parking lot to the lobby of the stately 1912 brick historic structure, the original home of the city’s police force, remodeled into office space in the 1980s. “When I bought the building a lot of the lights were out. Within two hours I had them fixed.”

The entrance to the building is gorgeous, and the floor occupied by the Stoll Bern PC law firm shows the building’s potential. But three floors are entirely vacant. Asked what he plans to do about the vacancies, Menashe smiles. “I’m going to fill them.” He nods his head. “And I can do it at very affordable rent levels.”

Not long after buying the police building, Menashe bought a 27-lot subdivision near Washington Square that had reverted to the bank after foreclosure. He plans either to resell the subdivision for a profit or build starter homes there and sell them. Asked about the risk of buying foreclosed property when the market is already flooded with more of the same, he says, “I have faith in this particular location and this particular market… Everything I buy, there’s a situation, and there’s a story. I want to know the story and understand the story.”

Menashe built his real estate empire piece by piece, starting out with $17,000 rental homes and making his first foray into downtown Portland with a lender-owned property that he still owns. He attributes his success to buying cheap for long-term value, paying off debts quickly and managing all his properties with a small staff of seven people. Most importantly, Menashe says he avoided over-buying during the boom years of 2004-2006. “People were spending way too much,” he says. “But they were spending other people’s money. I’ve never done that.”

When prices began to plummet in 2009 and 2010 he was able to bid low and pay cash. “My favorite thing has always been acquisition,” he says as he walks back to his office passing several other buildings that he owns along the way. “I’m looking to do some more right now.”

Menashe is a distinctly urban buyer, but the real estate deals in the current economy are by no means limited to downtown. It is also a busy time for John Rosenthal, president of Realty Marketing NW. His business auctions off a wide variety of properties throughout Oregon and the West, much of it bank-owned. The longer the real estate slump lasts, the better the deals become: a 26-acre mixed use property on 82nd Avenue in Portland for $4.65 million, 85 acres in Clatsop County for under $100,000, a residential lot on the Coast for $20,000 and dozens of parcels of timberland in Lane and Douglas counties for under $100,000.

Rosenthal is particularly optimistic about the opportunity in Oregon timberlands. For years large timber companies dominated the market, buying up land hungrily and selling rarely. That has changed dramatically as the timber industry has weakened. Several of Rosenthal’s clients have seized the opportunity to purchase large properties they would not have been able to afford in the past. “Even in this market, Oregon timberland is an attractive investment,” says Rosenthal. “And you can get in the game for under $100,000.”

Companies are looking for deals

It’s no surprise that after years of recession followed by sluggish recovery, companies are hesitant not only to hire but also to spend. That’s where the opportunity lies for vendors who can offer goods or services at a lower price or help businesses spend less by automating or outsourcing mundane tasks.

That’s why Test Systems Strategies Inc. (TSSI) is prospering in Beaverton. Every new computer chip that is designed must be tested, and TSSI has 30 years of experience testing chips using a standard methodology. Companies eager to get new products to market can save money by outsourcing that step in the process to TSSI.

“We save our customers money and help them get to market faster,” says CEO Hau Lam. He attributes his unusual success during the recession to hard work and innovation, saying that revenues grew by 20% in 2008 and 30% in 2009. TSSI also continued investing as the economy fell, buying a building on Millikan Way in 2007 and establishing headquarters there in 2008.

Lam is very tight-lipped about company specifics. TSSI went independent and private in 2005 after spinning off from publicly held Summit Design and does not share revenue figures or employee numbers. “We prefer to be a quiet success,” he says. “We are a small company with a huge reach. We don’t have our names on the product, but rest assured our fingerprints are on it.”

TSSI serves an extensive menu of global clients including Sony, Toshiba, Boeing, Toyota, IBM, Cisco and Siemens. That doesn’t include the steady supply of small startups inventing new technologies, as computer chips play ever-larger roles in the designs of cars, video games, smart phones, and practically everything else. “There will always be new companies building new technology with new chips for new uses,” Lam predicts. “Some will succeed and some will fail. But succeed or fail they will have to test.”

It probably doesn’t hurt that one of TSSI’s biggest clients, Intel, has had a stellar year and recently announced plans to invest billions of dollars into new plants. Nor does it hurt that Hau Lam is fluent in Mandarin, with connections in Beijing and in fast-growing Vietnam, where he was born and raised. The shift of business power to Asia is another area of opportunity. “It doesn’t matter where the company is, we can serve it,” he says. “We just want to make sure all the profits go through Beaverton.”

Consumers are looking for deals

The same trend that has businesses hunting for bargains also applies to consumers. They want to spend less but they don’t necessarily want to give up on quality. As a result clothing consignment shops such as Here We Go Again in Portland are doing more business than ever. Owner Chris Gauger saw an immediate rise in both buyers and sellers when the bottom fell out of the economy in September 2008, and her nine-employee, two-store business has grown steadily since, enabling a series of upgrades and investments.

The same trend that has businesses hunting for bargains also applies to consumers. They want to spend less but they don’t necessarily want to give up on quality. As a result clothing consignment shops such as Here We Go Again in Portland are doing more business than ever. Owner Chris Gauger saw an immediate rise in both buyers and sellers when the bottom fell out of the economy in September 2008, and her nine-employee, two-store business has grown steadily since, enabling a series of upgrades and investments.

“When the economy went down we started seeing people who never would have thought of consigning before,” she says. “People started asking themselves, ‘Do I really need three or four handbags?’”

With all the new merchandise flowing in from new sellers, Gauger was able to be extremely selective in her purchases. She estimates she turns away 80% of the clothes she gets offered, buying only the top brands in great condition. She is able to offer up-scale clothing for about half what it costs new, splitting the proceeds 50-50 with consigners. She estimates she writes about 500 checks to consigners per month. On a busy day her staff will bring in 50 to 100 new items selected from hundreds of offerings.

With sales picking up in both stores, Gauger moved to invest. She rebranded the business with a new logo, upgraded her in-store technology, improved her online presence by marketing through Twitter and Facebook and buying a space on the deal-of-the-day website Groupon, and organized a successful bus tour of the consignment stores of Portland on Super Bowl Sunday. She also managed to sprint through a low-budget, high-impact remodel at her store just off SW Macadam Boulevard without losing any store days.

First she did the painting herself with help from staff. Then she convinced her landlord to let her set up a short-term pop-up store in a nearby vacant space so she wouldn’t have to close for remodeling. She and her staff wheeled all the merchandise over into the temporary space in a single night and got the new space up and running for the next business day. While employees worked out of the temporary space, workers for the Portland-based contractor Interworks remodeled the store to improve the lighting and ambience. The project took a mere 12 days and cost less than $20,000. Gauger plans to remodel her store on Northeast Broadway next.

Gauger, a slim, energetic woman with a master’s degree in dance, was in a stressful position as the economy dropped off. She had just expanded into a second store, and recently had been diagnosed with breast cancer. Now both stores are doing great and her cancer is in remission. She finished the 5K Susan B. Komen Race for the Cure in Portland in less than 30 minutes.

The recession brought a whole new supply of customers that she has worked hard to win over, and the powerful national trend toward living simpler and greener plays into her industry nicely. “People want better stuff, and less of it,” she says. “We see that every day.”

It’s a good time to buy technology

Even as the economy slowed to a near-standstill, innovation in the technology sector continued to move at a dizzying speed. Software and hardware just get better, faster and more efficient — and in many ways, cheaper. It costs far less to start up a company than in the past, or to bring systems up to date, gain faster Internet connections, expand your marketing presence online, improve conversion rates and take advantage of cloud computing. Even more significantly for established but growing Oregon companies such as EthicsPoint, it is an extremely good time to purchase sophisticated technologies developed by individuals who don’t have the resources to commercialize them.

Even as the economy slowed to a near-standstill, innovation in the technology sector continued to move at a dizzying speed. Software and hardware just get better, faster and more efficient — and in many ways, cheaper. It costs far less to start up a company than in the past, or to bring systems up to date, gain faster Internet connections, expand your marketing presence online, improve conversion rates and take advantage of cloud computing. Even more significantly for established but growing Oregon companies such as EthicsPoint, it is an extremely good time to purchase sophisticated technologies developed by individuals who don’t have the resources to commercialize them.

EthicsPoint, a rapidly expanding Lake Oswego-based expert in the governance, risk and compliance industry with more than 2,300 clients, has built its business on the bottom-line importance of running an organization with integrity. The market for their services has grown as regulations have become more complex (think HIPAA and Sarbanes-Oxley) and laws on the books for years regarding bribery and corruption (think the Foreign Corrupt Practices Act) are enforced with more vigor in the wake of the financial crisis.

“There’s no shortage of opportunity for us,” says CEO David Childers.

EthicsPoint purchased two key technologies earlier this year at a fraction of the amount invested to develop them. The first is a policy manager technology that enables companies to set and track workplace policies and monitor their effectiveness. The second is a visualization tool developed for the Department of Homeland Security that enables users to layer data covering everything from crime and terrorist acts to weather and foreclosure rates onto interactive maps that help monitor risks proactively. That tool is built on layers, filters and feeds, and it aggregates data from a wide variety of sources. It is used by the U.S. Army to monitor troops in Afghanistan and by the Swedish Government to oversee its 9-1-1 program. EthicsPoint plans to offer it to clients in the first quarter of 2011.

“We used the down economy to take advantage of technology people had invested a lot of money in,” says Childers. “We were able to buy that technology at a very good price. Now EthicsPoint is in the awareness business. We can help clients identify events in real time that could pose a risk to their businesses.”

Both technologies play nicely into the EthicsPoint strategy to expand the menu of services available to its 2,300-plus clients. “We have 100 clients already clamoring for our visualization product,” which will be released in the first quarter of 2011, Childers says.

Other tech companies have also seized the opportunity to purchase key technology in this economy, the largest example being Intel buying the security giant McAfee for $7.7 billion. But the opportunity doesn’t apply only to tech giants. Prices for all types of businesses have fallen. The most recent data from the Internet’s largest marketplace of businesses for sale, BizBuySell.com, indicates that prices for local businesses are even lower now than they were a year ago. The current median asking price for Portland businesses is $249,750, down 14.8% from $293,000 a year ago. The data considers both listed businesses and the growing number of companies for sale by owner.

Nationally, the median sales price for small businesses is the lowest it has been since BizBuySell.com began tracking it in 2007.

Opportunity on the digital frontier

As much opportunity as there is in the buying of technology, there may be more in pushing technology forward. Businesses that devise new ways to do basic things more efficiently and with fewer headaches can grow very quickly in this environment.

For example, consider the work of systems administrators who oversee hundreds or thousands of machines at once. Portland startup Puppet Labs, one of the fastest-growing companies in Oregon, has developed a system to automate data center management, freeing up systems administrators to focus on work with more strategic importance to the organization. Founder and CEO Luke Kanies wrote the code for Puppet with a “fanatical focus on ease of use,” creating an open-source platform upon which software developers can share improvements and build applications.

The market potential for Puppet is huge. Tech giants such as Google and Amazon profit from data center management, but for most other companies it is a hassle and an expense. Kanies pitches Puppet as a means to free up a company’s technologists to do important rather than menial work, comparing it to the historic shifts from telephone operators to automated systems that improved service and offered more advanced opportunities in the industry.

Kanies positioned the Puppet brand as a frequent speaker at international open-source conferences and moved to build the company in Portland with $7 million in venture capital. Over the past year he has built the company from nine employees to 25, and he intends to grow to 50 next year. Already Puppet Labs has outgrown its funky Old Town office and is in the process of moving into 9,000 square feet on the top floor of a building on NW Park Avenue that will soon bear the company’s name.

As CEO of a rapidly growing technology company with big investments propelling it forward, Kanies has a different view of the real estate market from other business leaders. The low-rent, long-term lease is less appealing to him because a seven- to 10-year lease requires information about the future that is fairly unknowable at this stage. “Either I’ll be out of business in seven years,” says Kanies, “or we’ll be 700 employees.”

It goes without saying which of those options he would prefer. Like Jive Software before him, Kanies is trying to prove that the rapid-growth, investor-backed tech model can work in Portland and resist the gravitational pull of California (Jive recently moved its headquarters to the Bay Area but maintains a major presence in Portland). “I want to stay CEO and I want to stay in Portland,” says Kanies. “But we have to perform. That’s what it comes down to.”

In his view, the opportunity for innovation in the digital space is “unlimited.”