Health care reforms have Oregon businesses of all types and sizes gearing up for an uncertain future.

Health care reforms have Oregon businesses of all types and sizes gearing up for an uncertain future.

BY JON BELL

When it comes to state and federal health care reform, Eileen Brady is in deep.

When it comes to state and federal health care reform, Eileen Brady is in deep.

As one of the nine members of the Oregon Health Policy Board, she’s been busy providing oversight to the state as it has set out to insure Oregon children and to make health care more affordable and accessible to everyone. And as co-owner of New Seasons Market, the Portland neighborhood grocery chain that has grown into a 10-store, roughly $250 million business, Brady has 1,700 employees — and 900 of their family members — to think about as new health care regulations fall into place.

“Will we actually be able to create an affordable delivery system and will costs actually come down? That has yet to be answered,” she says. “I have a vested interest in answering that question.”

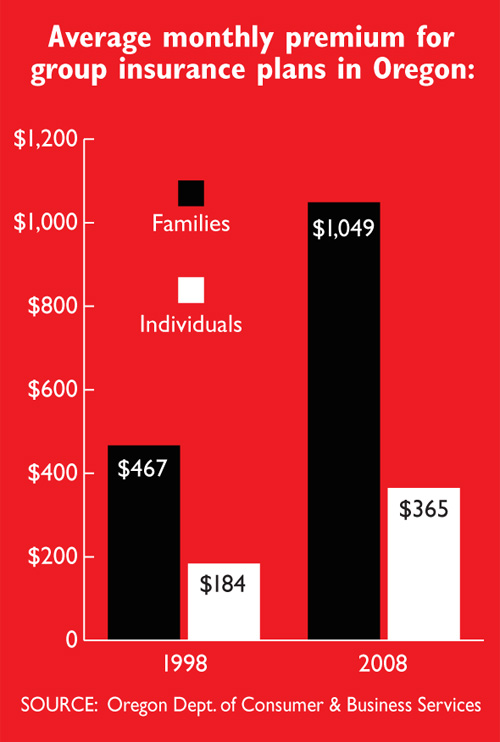

Six months after Congress and President Obama made an official stab at health care reform with the Patient Protection and Affordable Care Act, businesses are just beginning to glimpse the first provisions likely to impact their day-to-day operations. One example: as of mid-September, adult children up to age 26 were allowed to seek coverage through their parents’ health insurance plans, a move likely to boost costs for employers.

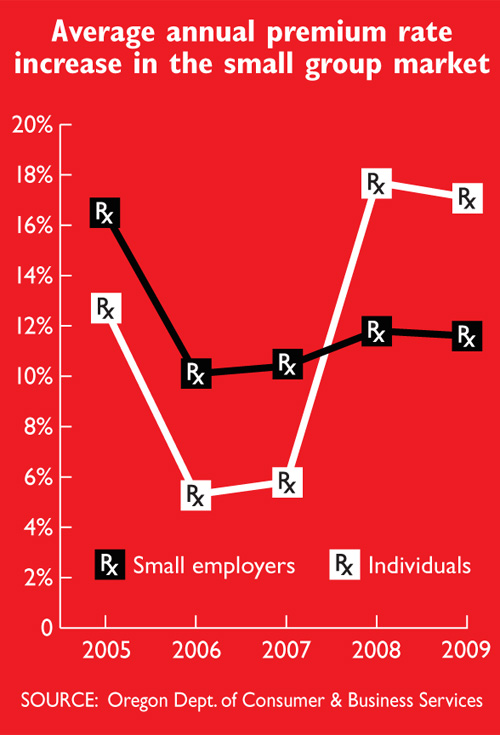

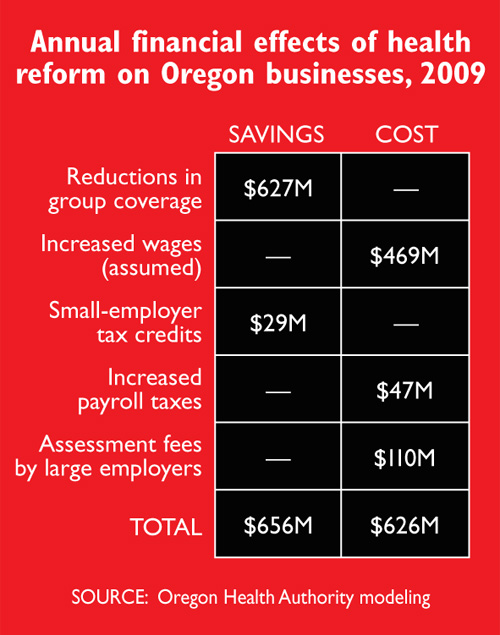

Other pieces of the legislation, such as health insurance exchanges, new tax credits for businesses and the requirement that all companies with more than 50 employees offer insurance, don’t take effect until 2014. Even so, businesses in Oregon are gearing up for the changes, some with excitement, others with trepidation, all with some amount of uncertainty. They’re also educating themselves, exploring their options, dealing with double-digit insurance increases — and trying to run their businesses.

Struggling with rising costs

A few more years of business-as-usual in the health care world could be bad news for John Clark and his Gresham rubber stamp company Stamp-Connection.

A few more years of business-as-usual in the health care world could be bad news for John Clark and his Gresham rubber stamp company Stamp-Connection.

Four years after he started his business in 2001, Clark began offering his employees — he has 11 total, including himself — 100% paid medical, dental and life insurance. He also covers his family and those of three managers.

Double-digit price increases over the past three years, however, have begun to tighten the line. The health benefits now cost the company, which has annual revenues of about $1.25 million, roughly $90,000 a year. And Clark is expecting similar increases over the next few years, which is why he’s anxious for health care reform to kick in.

“Any change is good at this point because the status quo is just killing us,” he says, noting that offering handsome benefits has helped him attract loyal, long-term employees. “We can’t keep going at this rate.”

To help deal with the cost increases thus far, co-pays for Stamp-Connection employees have risen slightly. If the expenses continue to rise, Clark says he may have to ask employees to contribute toward their monthly premiums. He says he also is concerned that costs could shoot up precipitously on the way to 2014 as health providers scramble to generate as much revenue as possible before new regulations take effect.

Under the federal reform, small businesses like Stamp-Connection that offer health benefits may be eligible for additional tax credits. Clarks says he’s also looking forward to the new insurance exchange, which he says might offer lower prices or at least make current providers more competitive.

But a lot could happen between now and 2014, so Clark isn’t looking at any of the reforms as definite. Instead, he’ll continue offering his employees the best benefits he can, encourage wellness among his workers and keep his fingers crossed that whatever comes of health care reform will be good for business — and the country.

“The next three years are going to be very telling as to how we shake this out,” he says, “but as a society, we really do need to shake this out.”

Absorbing the increases

Alan Mills, chief executive officer of the Beaverton architectural software firm Axium, sees health care reform from two different viewpoints.

Alan Mills, chief executive officer of the Beaverton architectural software firm Axium, sees health care reform from two different viewpoints.

“If I look at it from the company’s perspective, it’s an added cost that gives us zero benefit,” he says. “But as a business person and from the community and the U.S. standpoint, I can certainly see the benefit of having more people covered.”

Axium currently provides its 60 employees with 100% coverage through Providence Health Plans. The company also covers 45% of the cost of family members, and it contributes $75 a month into Health Reimbursement Accounts for employees to help with deductibles and co-pays.

Mills says Axium has faced sharp increases in health care costs over the past few years but has taken some steps to help minimize or at least control them. A large bump four years ago led Axium to up its plan deductible, and when another 12% increase loomed for July 2009, the company tweaked co-pays, prescription coverage and out-of-network services payments. The result: an increase of just 3.5%.

This year, however, the company was hit with an increase of nearly 21%. But rather than try to wring out even more savings, Axium absorbed the increase — about the cost of one full-time employee, Mills says — and even upped the family coverage from 35% to 45%.

Mills says federal reform probably won’t impact how the company provides insurance to employees. However, higher personal income taxes that will pay for some of the new reforms might have a more tangible effect.

“Some of those changes to personal income taxes are going to push up for business owners,” he says, “and anytime you take dollars out of any type of business, it’s going to impact the number of employees you have on staff.”

Under federal reform, businesses with 50 employees or more that don’t offer insurance face a per-employee penalty of $2,000 or more. While that may sound steep — and may send many more people to the insurance exchanges with federal subsidies — it may be a more affordable option for some employers.

“We wouldn’t foresee going that route unless the care was much better than we currently offer,” Mills says. “Whatever the case, if [reform] ends up costing us a lot more money, then we’re going to have to look at our entire cost structure.”

Finding a better deal

Amid all the talk these days about annual increases to companies’ insurance plans, Eugene-based Pacific Continental Bank enjoyed an almost unheard-of windfall last year: Monthly premiums dropped 2% to 3%.

Amid all the talk these days about annual increases to companies’ insurance plans, Eugene-based Pacific Continental Bank enjoyed an almost unheard-of windfall last year: Monthly premiums dropped 2% to 3%.

The bank, which employs 274 mostly full-time people, realized those savings by shopping around for a better deal. Pacific is also partially self-insured, which makes it less susceptible to market trends and impacted more by employees’ use of health care.

“Our employees were just healthier and there were fewer big claims,” says Rachel Ulrich, executive vice president and human resources director.

The bank currently offers employees a basic plan and also the option to buy up into an expanded plan. Pacific covers 100% of the basic plan for full-time employees and covers about 70% of the cost for family members. Ulrich says the company, which saw revenues of $58.4 million in 2009, spends about $1.7 million on health care each year.

Pacific is not, however, anticipating further cost decreases similar to last year. For starters, Ulrich says annual claims run in cycles, so last year was probably just the low end of that pattern. Second, one of the provisions of the new health reform law allows young adults up to age 26 to be covered under their parents’ health insurance plans.

“That’s probably going to be one of the biggest impacts for us,” says Ulrich, who herself has a 23-year-old son in the restaurant industry who could benefit from the coverage. “We may have to look at our family plans if use goes up as a result of that provision.”

She says Pacific might be able to absorb some future cost increases that come from federal reforms or continued upward trends; more than likely, however, the bank may have to look at charging higher co-pays or employee contributions toward premiums.

Though financial reform is tops on Pacific’s list at the moment, health care still ranks high among the bank’s primary business concerns. As for the new health care legislation and its impacts on Pacific Continental, the verdict is still out and probably will be for a while.

“It’s too early to say if it’s going to be good or bad,” Ulrich says. “I applaud the government for trying to find a way to fix health care. I’m just not sure this is it.”