Carbon pricing is gaining momentum in Oregon, sparking concern for energy-intensive businesses — but also opportunity to expand a homespun green economy.

A year and a half ago, Steve Clem, a vice president at global construction company Skanska, testified at the Oregon legislature in support of a bill to fund a study analyzing a state carbon tax. That study, “Carbon Tax and Shift,” written by the Northwest Economic Research Center at Portland State University and released in March 2013, set in motion a debate about whether the state should institute a mechanism for putting a price on carbon emissions.

Last year the legislature passed SB306, setting aside money for the research institute to redo the study with more geographic and industry specificity. The new research, released on December 8, 2014, lays the groundwork for lawmakers to consider a bill to create a carbon tax. If enacted, Oregon would be the first jurisdiction in the United States to have a statewide tax on carbon emissions.

Clem’s company would clearly benefit from a law putting a price on carbon. The firm focuses on energy retrofits and modeling the operational costs of carbon in new construction. “We have potential business offerings that would rely on putting a real value on carbon that we can’t offer clients yet because there is no demand for it,” he says.

Katie Fast, vice president of public policy at the Oregon Farm Bureau, does not share his enthusiasm. Fast is concerned a tax would make transportation fuels too expensive for farmers. Fuel costs are already likely to increase because of new regulations to reduce the carbon content in fuels, such as the state’s Clean Fuels Program, and a federal requirement for gasoline to have 10% ethanol blend. “That is probably all the market can handle right now,” says Fast.

Oregon clean-tech businesses favor carbon regulation for obvious reasons, but several energy-intensive and trade-dependent sectors argue they would face higher costs. These sectors include agriculture, electricity, steel, cement and waste management. Unsurprisingly, many of them are against carbon regulation at the state level, arguing it would hurt their competitiveness.

But a law to restrict or encourage the reduction of carbon emissions, which contribute to global warming, may be inevitable. And some claim it is better for Oregon to show leadership and get ahead of the curve by figuring out ways to be profitable from the new green economy.

Oregon is no stranger to efforts to put a price on carbon. In 2007 the state joined a regional partnership with California, Arizona, New Mexico and Washington — known as the Western Climate Initiative — that aimed to create a regional cap-and-trade program. But the program failed to gain political support among members, and California remains the only member of the Western Climate Initiative to have implemented a cap-and-trade program.

Now Portland State University’s carbon-tax study has put carbon pricing back on the political agenda. There is “near certainty carbon-tax legislation will be introduced in 2015,” says Richard Glick, a partner at law firm Davis Wright Tremaine. He wouldn’t be surprised if cap-and-trade legislation were introduced too.

Can Oregon’s economy, which is heavily reliant on manufacturing for jobs creation, prosper under the extra costs to businesses of a carbon tax? Sam Pardue, the CEO of Indow, a Portland-based maker of insulation products for windows, argues it can. Although a carbon tax would add costs to some industries that are heavily reliant on energy for the products they create, the sector relies more on intellectual capital to stay profitable, says Pardue. “Oregon is a big manufacturing state, but where we are strongest is where knowledge is getting applied to raw materials.” He points to the state’s semiconductor industry as a case in point. “While energy is an input into that process, information and knowledge are a far greater input into the silicon chips that get made here.”

National carbon taxes are inevitable, Pardue says. “The states that get a head start will be the ones that end up prospering.”

If Oregon instituted its own carbon-pricing system, it would join several U.S. states that already have carbon regulations (see map). Nine Northeast and Mid-Atlantic states are part of the Regional Greenhouse Gas Initiative (RGGI) cap-and-trade program for the power sector. California has been operating a cap-and-trade system since 2013. And Washington Governor Jay Inslee is pushing for a cap-and-trade program to reduce greenhouse gases in his state. British Columbia has had a carbon tax in place since 2008.

If Oregon instituted its own carbon-pricing system, it would join several U.S. states that already have carbon regulations (see map). Nine Northeast and Mid-Atlantic states are part of the Regional Greenhouse Gas Initiative (RGGI) cap-and-trade program for the power sector. California has been operating a cap-and-trade system since 2013. And Washington Governor Jay Inslee is pushing for a cap-and-trade program to reduce greenhouse gases in his state. British Columbia has had a carbon tax in place since 2008.

Jurisdictions that have carbon pricing do not report large-scale job losses that opponents of carbon regulation fear could happen if Oregon instituted its own tax. However, as Jock Finlayson, executive vice president at the Business Council of British Columbia, points out, the tax has created winners and losers — energy-intensive industries have seen their energy costs go up, and these additional costs have exceeded tax cuts, while low-emitting sectors, such as high tech, have benefited. British Columbia has not seen large-scale job losses as a result of its $30 CAD per ton ($25 USD) carbon tax. Petroleum use fell 17% in 2008 to 2013, while it increased by 3% in the rest of Canada, according to a report by the think tank Sustainable Prosperity.

The Canadian province’s cement industry has been among the most vocal business sectors to denounce the tax. In May 2014 the Cement Association of Canada put out a press release saying local producers had lost nearly a third of their market share to imports since the inception of the tax seven years ago.

California’s cap-and-trade system covers the power and industrial sectors, and expanded in 2015 to include the transportation fuel and natural gas sectors. Susan Frank, director of the California Business Alliance for a Clean Economy, says the state’s climate change law, AB32, which includes a renewable portfolio standard and a low carbon fuel standard, has created jobs and boosted the economy.

“There has been no evidence, despite claims to the contrary, that AB 32 is destroying the California economy,” Frank says. “There is plenty of evidence that quite the opposite is true: that California is benefiting from clean-tech investments; that new jobs are being created; that for every job we might lose in the oil and gas sector, we are gaining more jobs in the energy-efficiency sector.” The members of Frank’s association come from all sectors, not just clean tech. Frank, who served for eight years as the president and CEO of the Palo Alto Chamber of Commerce, formed the group in 2008 partly to give a voice to non-clean tech businesses that supported action on climate change. “We have small clean-energy companies, but I also have a mattress shop and a coffee shop, a media outfit, and people who are not attached to the clean energy space who are saying this is not going to hurt us; this is going to make us better.”

A study on the economic impact of the East Coast’s RGGI cap-and-trade program for the power sector shows the carbon-pricing program has benefited the economy in member states. The program is set up so that states disburse most of the revenue from the sale of emissions allowances — $912 million between 2009 and 2011 — back into the economy on energy efficiency, renewable power projects, assistance to low-income households to pay electricity bills, and to education and job training. The 2011 study by the Analysis Group concluded the disbursement boosted member states’ economies by increasing purchases of goods and services, such as engineering services for audits and sales of energy-efficiency equipment.

RGGI also led businesses and consumers to spend less on electricity bills because states invested a large amount of the allowance proceeds on energy efficiency. The study’s authors estimate RGGI produced an overall net reduction of $600 billion in electricity bills between 2009 and 2011.

Back in Oregon, support for a carbon tax hinges on whether companies feel they will make or lose money on a low-carbon economy.

Clem at Skanska says a lack of carbon-pricing policy means Oregon’s homegrown environmental expertise is exported abroad and elsewhere in the U.S. rather than kept in state. Oregon is known for taking leadership on environmentally sound infrastructure, such as the construction of a wide network of bike lanes and the Portland Streetcar. But it lags behind in instituting more far-reaching green policies, like a carbon price mechanism and a low carbon fuel standard, which would benefit the state’s myriad environmental design, engineering and consulting firms.

Clem at Skanska says a lack of carbon-pricing policy means Oregon’s homegrown environmental expertise is exported abroad and elsewhere in the U.S. rather than kept in state. Oregon is known for taking leadership on environmentally sound infrastructure, such as the construction of a wide network of bike lanes and the Portland Streetcar. But it lags behind in instituting more far-reaching green policies, like a carbon price mechanism and a low carbon fuel standard, which would benefit the state’s myriad environmental design, engineering and consulting firms.

“There is more demand for our services in places other than Oregon because we don’t have mechanisms in place that would drive the business here,” Clem says.

Oregon’s renewable-energy industry would also benefit from carbon pricing. The state has some of the largest wind farms in the world. Much of the financing for these types of projects depends on unstable tax subsidies that frequently expire. One of these is the federal renewable-electricity production tax credit for renewable-energy projects. It expired at the end of 2013, putting an end to new large-scale wind project development across the country.

Iberdrola Renewables, a Portland-based power producer and the second-largest wind operator in the U.S., says a stable carbon price signal would help drive long-term renewable energy investments, which can run into hundreds of millions of dollars. “There are so many variables to investing in renewable energy. But an efficient, predictable and sustainable price on carbon would be a much better policy, especially nationally, than what we have today, which is a tax incentive that expires every year. That is not a great way to build a lasting growth plan,” says Kevin Lynch, vice president of external affairs at Iberdrola.

Iberdrola Renewables, a Portland-based power producer and the second-largest wind operator in the U.S., says a stable carbon price signal would help drive long-term renewable energy investments, which can run into hundreds of millions of dollars. “There are so many variables to investing in renewable energy. But an efficient, predictable and sustainable price on carbon would be a much better policy, especially nationally, than what we have today, which is a tax incentive that expires every year. That is not a great way to build a lasting growth plan,” says Kevin Lynch, vice president of external affairs at Iberdrola.

Oregon’s energy-intensive sectors are the clear losers from a carbon tax. They will face higher costs from a tax with the rise in fuel costs. Some prefer to stick with tax incentives to support their sectors’ adoption of low-carbon alternatives.

Other industries favor direct regulatory standards for greenhouse-gas reductions rather than a market-based carbon price. Rich Angstrom, president of the Oregon Concrete & Aggregate Producers Association, which represents the interests of employers such as Ash Grove Cement Company in Lake Oswego, says industry-specific standards for reducing carbon emissions would be preferable to a carbon tax because the standards could be tailored to the needs of individual sectors. “If a standard is set by the state agencies, we can have a discussion of what is achievable for each enterprise,” says Angstrom.

Two of the largest electric utilities in Oregon are skeptical a carbon tax can achieve large emissions reductions. Sania Radcliffe, director of government affairs at Portland General Electric, says legislators would not be able to set a carbon tax high enough to achieve meaningful reductions. One disadvantage of a carbon tax is that it does not guarantee a limit or a cap on greenhouse-gas emissions like a cap-and-trade program does. While emissions reductions are likely under a carbon tax, it does not guarantee Oregon will meet its greenhouse-gas reduction goals.

Having a state-based carbon tax is a worry for PacifiCorp, which operates across six states and imports electricity into Oregon from fossil-fuel power plants it owns out of state in jurisdictions that don’t have carbon price regulations. Scott Bolton, vice president of community and government relations at Pacific Power, a division of PacifiCorp, says: “If the goal is to provide a price signal that causes you to use less of a high-emitting resource than you normally would, that doesn’t change how we as a company on an integrated basis across six states would operate our system, which defeats the goal of a carbon tax.”

Bolton argues his company is already subject to carbon constraints because of federal rules that the Environmental Protection Agency is implementing under section 111D of the Clean Air Act (see sidebar: “Cleaning up power”). That regulation, which will be finalized in June, sets greenhouse gas reduction targets for existing power plants.

PacifiCorp already factors in carbon prices when it analyzes what generating sources it will need over a 20-year time frame. It does this because of the likelihood carbon regulations will be introduced at some point in the future. In its 2015 resource plan, the utility will analyze potential future carbon-emissions costs applied as a tax based on current carbon price mechanisms. It assumes a carbon price starting in 2020 at approximately $22.39 per ton, rising to $75.77 per ton by 2034 in one scenario, and to $161.74 a ton by 2034 in another.

Based on these assumptions, the company has chosen to invest more in low-emitting sources of energy and energy efficiency, says Bolton. “We declared back in 2007 that we were putting a moratorium on new coal plants because the risk of regulation was too much. It has helped guide a steady investment in renewables, particularly wind, and combined- cycle natural gas.”

Like PacificCorp, many Oregon businesses are moving forward with incremental carbon-reduction initiatives. But as concern mounts regarding the environmental and economic impacts of climate change, more ambitious efforts to address climate change are gaining momentum globally, as well as locally. More than 200 Oregon companies signed the Business for Innovative Climate & Energy Policy Declaration, a project of Ceres, an organization advocating for sustainable leadership. The initiative calls on policymakers to pass meaningful energy and climate legislation. Signatories include large Oregon businesses such as Adidas Group and Intel, as well as small, locally owned entities, like Hot Lips Pizza and the Joinery.

The U.S. and China — the world’s two largest emitters of greenhouse gas — have made headway on agreeing to reduce their share of carbon pollution. In November the two countries issued a joint climate change announcement: President Obama pledged a new target to cut greenhouse gases 26 to 28% below 2005 levels by 2025. China’s president, Xi Jinping, announced his country’s carbon dioxide emissions will peak around 2030.

Investors are also putting more pressure on governments to adopt carbon-pricing regulations. In September 364 investors representing more than $24 trillion in assets signed the Global Investor Statement on Climate Change, which calls on governments to provide “stable, reliable and economically meaningful carbon pricing that helps redirect investment commensurate with the scale of the climate-change challenge.”

An increasing number of global corporations are using carbon pricing to manage risk and plan ahead. A report released in September by the Carbon Disclosure Project, an initiative to encourage companies to report environmental information, shows 29 U.S. companies — including Dow Chemical Company, Bank of America and ExxonMobil — are incorporating a carbon price into their business planning and risk management.

In Oregon a carbon tax could take the state’s burgeoning green economy to the next level. Some businesses, no doubt, will fight the extra costs. But for many, carbon pricing is already a reality, and inevitable for others. “The world will probably turn to carbon pricing,” says B.C.’s Finlayson. “We are operating on the premise that carbon constraints would be adopted over time.” n

Click through for more information on the PSU carbon-tax study and the impact of the tax on emissions reductions.

Carbon tax: By the numbers

The PSU carbon tax study shows as long as revenues are used to benefit businesses, such as for corporate tax cuts or to provide relief to companies in highly competitive sectors, the tax would have a minimal impact on businesses. Job losses, for example, would be “a fraction of 1 percent of total state employment,” says study co-author Jeff Renfro, senior economist at PSU’s Northwest Economic Research Center.

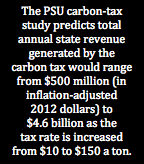

The authors analyzed the economic impact of carbon prices in the $10 to $150 per metric ton of carbon dioxide equivalent range. They assume the tax starts at $10 per ton in 2014 and increases by $5 or $10 per year until it reaches a maximum $150. A carbon tax of $60 per ton or higher could provide the reductions necessary for Oregon to achieve its goal of a 10% decline in greenhouse gases below 1990 levels by 2020.

The researchers analyzed the economic impact of a carbon tax on four industries: outdoor gear and activewear, advanced manufacturing, high tech, and forestry and wood products. These sectors would see small increases in job losses with a $30 per ton carbon price. Industries at the end of the supply chain, such as retail and some service industries, would be impacted the most because they are unable to pass on price increases without loss of revenues. However, these job losses are offset by job gains in the clean-tech sector.

What extra energy costs would businesses face if a carbon tax were instituted? Every dollar of tax on one ton of carbon emissions corresponds to a little less than one cent on a gallon of gasoline. For natural gas, a $10 carbon price would lead to a 3% increase in one unit of natural gas, while a price of $100 would increase natural gas prices by 31%. Electricity price increases would vary by region: a $10 carbon price would increase prices by 1.5% to 5%, and a carbon price of $100 per ton would increase electricity prices by 17% to 51% depending on the utility service area.

The emissions gamble

Some argue a carbon tax is not an effective policy tool in helping states meet their greenhouse gas emissions targets. While it provides carbon price certainty to businesses, a tax does not guarantee emissions reductions. Only a cap-and-trade program can do that.

Portland State University’s carbon study suggests a carbon tax rate of $60 per metric ton or higher could alone provide the reductions necessary for Oregon to achieve its target of a 10% reduction in greenhouse gases from 1990 levels by 2020. But it finds the state’s long-term goal of a 75% reduction by 2050 will not be reachable through a carbon tax alone with tax rates up to $150 per ton. Without big changes to the state’s fuel mix it will be “very challenging – if not impossible – to meet this 2050 goal,” the study says.

Sania Radcliffe, director of government affairs at Portland General Electric, says a carbon tax at both a low and high level would not achieve enough declines in greenhouse gases. “It is unlikely they could set a carbon tax at a level high enough to drive meaningful reductions above and beyond what existing policies will drive anyway, because it would cost too much. At a lower level, it will not drive carbon reductions meaningfully – at least in our sector.”

Cap-and-trade programs are more effective at guaranteeing reductions because they set a limit on the amount of greenhouse gases companies can emit. Emitters receive or buy a finite number of emissions allowances as part of the cap. The number of allowances available declines over time as the emissions cap ratchets down. Carbon prices are less stable under such a system than with a carbon tax because the supply and demand of permits in the system determines the market price. But the certainty of emissions reductions are much higher, and for that reason, cap-and-trade is a preferred method among environmentalists.

Sean Penrith, executive director of The Climate Trust: “In the short term, carbon tax offers benefits to businesses because they can factor in the cost. In the long term, it is not that great because the impacts of climate change are upon us and will be more severely so. The impact to those businesses will be a multiplier of the costs they are considering on a tax. In the long term, we need to look at the containment of CO2 and only cap-and-trade can give you that.”

Past experiences of cap-and-trade programs show that this form of carbon pricing can be ineffective if regulators do not set the cap at the appropriate level. In the case of the Regional Greenhouse Gas Initiative, the initial cap on power-sector emissions – set at 188 million short tons from 2009 to 2011 – was too high to drive down meaningful emissions output. Although power plants’ emissions fell well below the cap, it was mostly the result of power companies switching to burning lower emitting and cheaper natural gas instead of coal. This led to a collapse in carbon allowance prices and produced little incentive for power plants to reduce emissions beyond what they needed to do to meet the program targets. RGGI states last year tightened the program’s emissions cap to make it more stringent.

Cleaning up power

In the absence of federal climate legislation, the Obama administration took executive action in June 2013 to reduce power-sector emissions by directing the Environmental Protection Agency (EPA) to create carbon-pollution standards for existing power plants under section 111D of the Clean Air Act. The agency projects the rule will achieve a 30% reduction in power plant carbon emissions from 2005 levels by 2030 and a 25% reduction by 2020.

Power companies say it is difficult to predict how much it will cost to comply with the standard because the rule is not finalized. The EPA has proposed several methods of meeting the standard, which include well-established industry practices, such as increasing power plant efficiency, investing in renewable energy and improving energy efficiency.

Some electric utilities prefer the federal standard over a state carbon tax. Sania Radcliffe, director of government affairs at Portland General Electric, says the EPA rule could have a “significant impact on carbon reductions in our sector.” Scott Bolton, vice president of community and government affairs at Pacific Power, says the rule is “based on real measures that produce real reductions.”