Sizing up three decades of ups and downs, saints and scoundrels, crashes and triumphs.

Sizing up three decades of ups and downs, saints and scoundrels, crashes and triumphs.

Story by Ben Jacklet

Story by Ben Jacklet

A lot has changed in Oregon business over the past 30 years. And it isn’t just the bushy moustaches, the plaid slacks or the ads for new-fangled gizmos like the $13,385 Durango F-85 desktop computer, a futuristic machine able to “do all your accounting, maintain inventory control, perform job costing, sales analysis and much more!”

In 1981, Oregon had eight publicly traded wood products companies: Georgia Pacific, Louisiana Pacific, Willamette Industries, Pope & Talbot, Alpine, Bohemia, Dant & Russell and Medford Corp. It was a formidable group led by Georgia Pacific, a $5.4 billion business and the largest timber company in the world. Willamette and L-P also topped a billion dollars in annual sales. The state hummed with mills.

Georgia Pacific was the first to leave, departing for Atlanta in 1982. Then Alpine and Dant & Russell folded. Next, Texas millionaire Harold Simmons bought Medford Corp. in a hostile takeover. Willamette bought Bohemia in 1991, only to be bought in a hostile takeover by Weyerhaeuser, based in Washington, in 2002. Louisiana Pacific left Portland for Nashville in 2004. That left Pope & Talbot, which declared bankruptcy in 2008.

| {artsexylightbox singleImage=”images/stories/articles/archive/jan2011/slideshow-intro-30YearGraphs.jpg” path=”images/stories/articles/archive/jan2011/30YearGraphs”}{/artsexylightbox} |

It isn’t just the timber industry that has seen seismic shifts. After Georgia Pacific left, the top six Oregon-based public companies were the utility PacifiCorp, the retailer Fred Meyer, the tech giant Tektronix, U.S. Bancorp, and L-P and Willamette. These companies employed a combined 85,000 people in 1986. Not one survives as an Oregon-based business today.

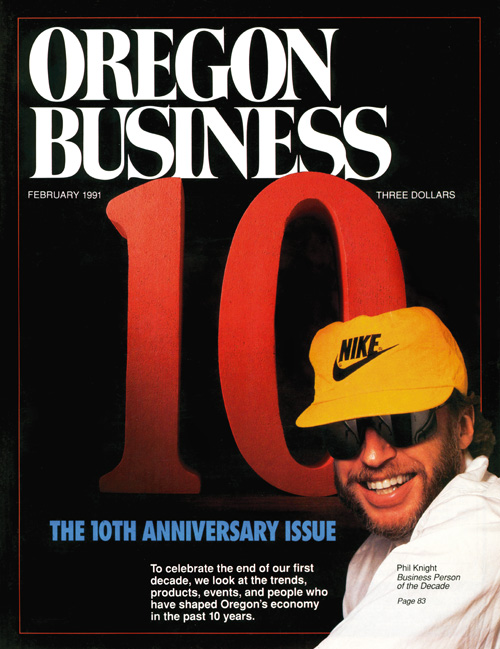

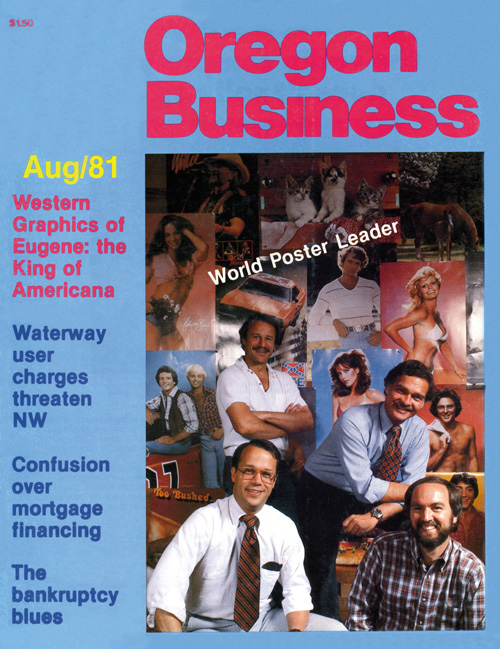

But for every company that left, another grew up and prospered here. The first issue of Oregon Business contained an interview with Phil Knight explaining the decision to take his small but promising shoe company public. Three decades later Nike is a $20 billion company, the world’s dominant player in athletics. And the little ad agency it spun off in 1982, Wieden+Kennedy, isn’t doing badly either. Those two companies now anchor two of the state’s most dynamic industries, the creative sector and the outdoor and athletics cluster.

In 1982, FLIR Systems was a struggling startup looking for investors. Wieden+Kennedy was an untested ad shop with one client. Leatherman Tool Group was an idea in the making. Tripwire, Ziba Design, New Seasons Market, Laika, HemCon, Gerding Edlen, WellPartner, Jive Software and Puppet Labs did not exist. Intel was a fairly minor employer in Oregon.

Not all of the changes have been dramatic. It is a little disconcerting to be reminded how many of Oregon’s “next big things” have been next big things for 30 years and counting, including wood pellet stoves, biomass energy and solar power. Thirty-year-old headlines like “Timber companies await recovery,” “Hope springs eternal in real estate market,” “Turning downtowns around” and “Bringing Oregon into the big leagues,” could just as well have been written last week. Chances are they will still apply 30 years from now. But history reminds us that you never know what will happen.

Gilding the lily

|

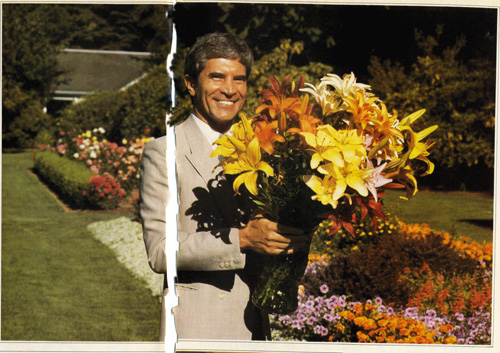

From the September 1985 issue: George Heublein and his multinational flower company was profiled. By 1987, his company was bankrupt. Heublein was finally arrested in 1997. |

Among the many Oregon companies that have vanished over three decades were Oregon Software, the Bank of Oregon, Air Oregon and Oregon Bulb Farms. Of these, the one that fared best in the 1980s was Oregon Bulb Farms, the Sandy-based inventor of the Asiatic hybrid lily.

It was owned by a business named Melridge and run by a charismatic CEO with a background in accounting named George Heublein. Heublein took Melridge public in 1983 after devising a system for licensing his lilies to royalty-paying Dutch growers. He hedged currency fluctuations by buying flowers on both sides of the Atlantic, in Seattle and in the Netherlands, and his strategy was an immediate hit. The company produced 11 million bulbs in 1984. Its stock tripled. Heublein graced the cover of Oregon Business in September 1985 with the headline “Flower Power.”

In 1986 the company made more than $25.6 million, bought four businesses and was lauded as one of the top stocks in the Northwest, along with Costco, Boeing and Precision Castparts. In 1987 Heublein met with the president of Burundi to establish a flower farm in sub-Saharan Africa, employing 50 Burundians. By this point Melridge’s stock had shot up from its original $5 a share to over $36. Heublein was a multimillionaire.

Then the whole thing fell apart. It turns out the former accountant had been gilding the proverbial lily, embellishing the numbers to encourage investments. By the end of 1987 Melridge was bankrupt and investors were suing the company and its auditors. The authorities came looking for Heublein but he was nowhere to be found. Looking back on the debacle, longtime Oregon Business editor Robert Hill wrote in 1992: “We have since instituted a corruption release clause which all cover subjects must sign. If they flee the country after being on our cover, they must take us with them.”

Heublein eluded capture until 1997, when he was arrested in Florida and sentenced to five years in federal prison. He and his partners paid $88 million to settle the various lawsuits from investors.

King of the car wash

|

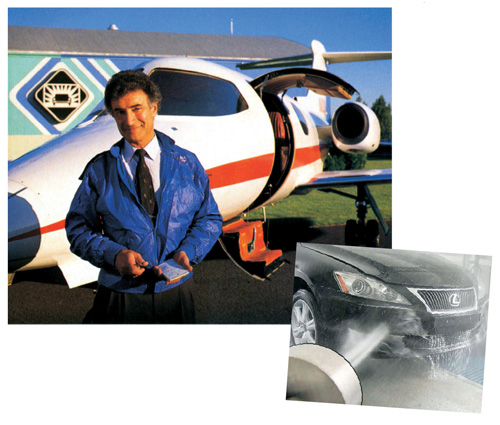

From the October 1987 issue: Dan Hanna, founder of Hanna Carwash International. Hanna Car Wash Systems are still sold on the Internet. |

Dan Hanna used his mother’s mortgage to finance his first car wash in 1954 at the age of 19 and immediately set to work tinkering to make it better. His improvements paid off quickly. By 1967 he had bought his first Learjet, an investment he credited with growing his business by 500% the following year. That was just the beginning.

By 1987, Milwaukie-based Hanna Industries had 30,000 patented automatic car washes in 66 countries and annual sales of over $70 million. Hanna broke the world speed record in his Learjet, drove race cars for fun and signed his company on as the principal sponsor of Mario Andretti in the Indianapolis 500. He told Oregon Business that he still insisted on working regular shifts in his company’s car washes even as his business grew to dominate the market.

Unlike Heublein, it wasn’t fraud that did Hanna in. It was bad luck and unfortunate timing. In the late 1980s, as national environmental laws were tightening, he bought dozens of car wash franchises on former gas stations with leaking underground storage tanks. The liability proved overwhelming. The company went bankrupt in 1990, and creditors who were owed more than $40 million forced Hanna out of power.

He later bounced back to build a new business, Dan Hanna Products, but he was unable to regain control of the brand he had built with such flair. Hanna died in 2005, but his mechanical innovations live on in Hanna Car Wash Systems, marketed on the Internet as “the world’s leading manufacturer of car-wash equipment and systems,” a division of the Houston-based Jim Coleman Company.

As the Tek spins

|

The most recent version of PSU’s Silicon Forest Universe Poster explores the relationships between 894 Oregon tech companies. |

For years Oregon’s biggest business employer was Beaverton-based Tektronix, which peaked at 24,000 jobs in the early 1980s. The number of jobs there has dropped steadily over three decades, with the latest blow being a recent decision to transfer production to China. But that is only part of the Tektronix story. The real legacy of the Tek phenomenon is the multi-generational, interwoven ecosystem of technology companies loosely referred to as Silicon Forest.

Dissertations have been written about the complex interrelationships between Oregon’s early tech giant and its spinoffs and their spinoffs. The first big hit was Floating Point Systems, developed by veteran executive Norm Winningstad, who was with Tek from 1958 to 1970. Floating Point, a computing company named for the mathematical concept of digits too small or large to be represented by integers, blossomed like Microsoft in the early ’80s, growing from $42 million in sales to $127 million in three years. By 1985 Floating Point had 1,600 employees and $14.4 million in profits.

Then the company began pouring R&D money into a new type of computer. The project failed, and the company never made another profit. Its stock dropped by 70% in 1987 and it lost $27.7 million in 1988. By the end of 1991 Floating Point’s assets had been sold off in bankruptcy.

During the same year that Floating Point’s stock dropped by 70%, the stock price for another Tek spinoff, Mentor Graphics, shot up 70%. Mentor’s founder, Tom Bruggere, was a Vietnam vet who left Tektronix to launch a startup in a 300-square-foot rented office. In an early interview with Oregon Business he described making all his East Coast calls at 9 a.m. to catch people at lunch and get them to call back on their nickel. Bruggere’s original business plan called for sales of $5 million in 1983; the actual figure came in at $26 million.

Mentor never quite became the Fortune 500 company that Bruggere intended to build, but it did manage to avoid the fate of Floating Point and so many other technology companies that have vanished. The company expects revenues of about $900 million for fiscal 2010 and has mentored its own set of startups. The latest Oregon tech company to score millions in venture funding, Act-On, is a project of Mentor Graphics alumnus Raghu Raghavan.

Another Tek spinoff, TriQuint Semiconductor, narrowly avoided failure in 2002 and has bounced back powerfully since, with lucrative defense contracts and a profitable collaboration with Apple on the computer chips that power iPhones. Other surviving enterprises that grew out of the Tek culture range from Planar Systems to Merix. By the time Danaher Corp. bought Tek for $2.8 billion in 2007, the seeds for the Silicon Forest had been well sown.

Even the dramatic failure of Floating Point doesn’t look entirely like failure in retrospect. The company and its legendary founder pushed forward new technology, spawned a dozen spinoffs of its own and lured new money into the local tech scene from major players including STMicroelectronics and Sun Microsystems. Winningstad died Nov. 27, 2010, at the age of 85.

A mighty wind

|

Thirty years ago, Pacific Power & Light was pushing a proposal to build Oregon’s first wind farm, south of Coos Bay. The Whiskey Run wind farm was built and operated for a few years.

The catalysts that ultimately got the wind energy business blowing were two key pieces of state legislation. The first was Oregon’s Renewable Portfolio Standard, which required utilities to provide 25% of their power from renewable sources by 2025. The second was the state’s aggressive Business Energy Tax Credit, which was greatly expanded in 2007 and subsidized up to half of the project costs for major renewable energy projects. With utilities scrambling to meet state requirements and investors angling to get in on the BETC windfall, windmills sprouted like wheat stalks in the far-flung properties of Eastern Oregon.

Today Oregon is a national leader in wind power, with more than 1,200 turbines and plans to build the world’s largest wind farm in Gilliam and Morrow counties. The state’s top utilities, Pacific Power and Portland General Electric, have become major investors in wind energy. Two of the world’s biggest players in the wind industry, Denmark’s Vestas and Spain’s Iberdrola, have established North American headquarters in Portland. The wind turbine giant Vestas stood up Oregon in favor of Colorado for its North American manufacturing operations, but recently announced it will build a $66 million super-green headquarters building in the Pearl District. Not surprisingly, that deal is financed in part by public subsidies.

Away with aluminum

|

Aluminum manufacturing powered towns such as The Dalles in the 1980s and 1990s, but the bottom fell out in 2001. |

The aluminum industry was a powerhouse in the 1980s, back when power came cheap. Some 7,000 people worked at 10 smelters in the Pacific Northwest in an industry that relied on subsidized power from the Bonneville Power Administration. In 1986 BPA altered its direct service contracts to tie power rates to the price of aluminum. A young entrepreneur named Brett Wilcox was able to restart the smelter in The Dalles, and wealth spread as the aluminum price tripled, driven by Japanese demand. The results were big bonuses for The Dalles workers, big profits for Big Aluminum and a $221 million bonus to BPA.

It was the proverbial win-win, until everyone started losing. The bottom fell out in 2001, when electricity prices soared as a result of utility deregulation and aluminum dropped to 60 cents a pound, less than the price of production. The decision by several aluminum companies to resell their subsidized power on the open market rather than employing people did not sit well. The subsidies went away, and so did thousands of blue-collar jobs. Former aluminum towns were left to court new suitors. The Dalles brought in Google with a new set of subsidies. Troutdale is the site of a humming new FedEx operation.

Toy stories

|

View-Master was developed in Portland in 1939. |

The hottest Oregon stock 30 years ago was not Nike. It was Animated Electronics. Founded in 1978, Animated went public in 1981 and quickly earned shareholders a 134% return on investment, nearly tripling Nike’s performance. The company’s primary product, the Lucky Eggs Machine, dispensed colored eggs from vending machines in grocery stores for a quarter. President Robert Poirier nabbed licensing rights from Hanna Barbera to use the likenesses of Fred Flintstone and Scooby Doo on his merchandise, and just like that parents had a whole new way to dispose of their change while shopping — and Oregon had a wildly successful public company. But the goodies inside turned out to be booby prizes.

Within a few years Animated Electronics had become MSM Systems, a company that focused on plastics injection molding using the raw material MSM, imported from Japan. From there things went downhill quickly. The Food and Drug Administration began seizing shipments of MSM, calling it an unapproved food additive. The company’s losses piled up and the lawsuits multiplied. Poirier stepped down in 1984, the same year his side company, Chocolates of Switzerland, also landed in bankruptcy court. Poirier and his associates stood accused of spending company money on elaborate home remodels and expensive trips to Switzerland. The legal mess took years to unravel.

Another Oregon-based toy company, View-Master, fared much better in the 1980s, only to experience disaster of a different variety. View-Master grew from $35 million in sales in 1983 to $106 million in 1986 cranking out the iconic three-dimensional image viewers first developed in Portland in 1939.

Then Tyco bought the operation in 1989 and Mattel bought Tyco in 1997 with plans to cut labor costs. Mattel was in the process of shifting hundreds of jobs from Beaverton to Mexico when environmental tests showed that the plant’s drinking water source was contaminated with the industrial solvent trichloroethylene at 300 times the government’s allowable limit. Water formerly used for drinking was hauled off and disposed of as hazardous waste. Former View-Master employees filed numerous workers’ compensation claims attempting to link the tainted drinking water to health problems, but all were denied. Mattel continues to make View-Masters in Mexico.

Going to the Dogs

|

The Multnomah Kennel club has been vacant since 2004. The dogs could not compete with the lottery games and casinos. |

Another public company on the rise 30 years ago was the Multnomah Kennel Club, the greyhound racing track in Wood Village. The Kennel Club’s best season was in 1987, when 611,430 people visited the track and wagered $55.67 million. President and CEO George Dewey told the Oregonian, “We’re the No. 1 spectator sport in the state.”

Not for long. The dogs could not keep pace with the Oregon Lottery, video poker, off-track betting and Indian casinos. Magna Entertainment Group took over in 2001 but could not compete with the growing monopolies overseen by the state and the tribes. Magna shut down the track in 2004 and it has sat vacant since. Today it is the site of a long-planned gamble to develop the first non-tribal casino in Oregon, a gargantuan enterprise complete with water park, bowling lanes, 3,500 slot machines and projected revenues of $589 million per year. Voters shot down that idea decisively in November.

The Internet killed the video stores

|

Hollywood Video was founded in Southeast Portland in 1998 and filed for bankruptcy in 2009. // PHOTO BY KATHARINE KIMBALL |

In 1979 there were no video stores in Oregon. By 1982 there were 3,000. The home movie rush brought opportunity for independent shopkeepers and boosted at least two major Oregon companies: Rentrak, which tracked rentals for movie companies, and Hollywood Video, which rented them to consumers. Rentrak has since branched into all manners of data tracking, from on-demand video to cable television to box office receipts. Hollywood Video and its owner Movie Gallery, based in Wilsonville, stuck with the same formula for as long as it could hold, filing for bankruptcy in 2009. It remains to be seen how many video stores will survive the ascendance of Red Box and Netflix, but chances are the number will be closer to zero than 3,000.

A woman’s place

In the early days, it was mostly white guys in suits with

|

|

Gert Boyle today and in the July 1984 issue. Boyle, the chairman of the board of Columbia Sportswear, was one of the few women leading a company in the 1980s. |

receding hairlines. The first 120 issues of Oregon Business featured just four women on the cover. The first to break through was Ann Person, president of Eugene-based Stretch & Sew, in July 1984. An accompanying story titled “Women in Command” noted that just two of the state’s top 100 private businesses and none of the publicly held companies were run by women.

One famous exception was and is Gertrude Boyle, who grew sales at Columbia Sportswear from $650,000 in 1970 to $14 million in 1983 and $1.3 billion in 2008. Other women who have risen to power in today’s more inclusive culture include former PacifiCorp CEO and current Marylhurst University president Judi Johansen, longtime Qwest executive Judith Peppler, U.S. Bank Oregon president Malia Wasson, winery founded Susan Sokol Blosser, Jill Eiland of Intel, Julia Brim-Edwards of Nike and Schnitzer Steel CEO Tamara Lundgren.

Less well known is the story of Person and her Stretch & Sew franchise. An avid crafter in the days before crafts were cool, she sensed a market opportunity in teaching others to sew with knitted fabrics, especially polyester. By the 1970s she had designed her own line of patterns, written her first book and begun licensing franchises across the country. By the 1980s she had more than 100 franchises under license. For years she had her husband serve as president even though it was her company — based on his belief that banks would not lend to a woman running a company. After she divorced her husband she proved him wrong by borrowing $4 million and repaying it on schedule.

Person, now 85, lives on a ranch in Creswell. Her daughter Mindy Moore is president of Stretch & Sew in Tempe, Ariz. Her granddaughter Cory Pfitzer is vice president.

The latest U.S. Census figures show 29.7% of Oregon companies are owned by women; the national rate is 28.7%.

The Car Czar

|

From the October 1984 issue: Scott Thomason’s car company was one of the state’s top private companies in the 1990s. Thomason left Oregon in 2003. |

Scott Thomason bought the family car dealership from his father in 1983 and built it into a nine-new-car dealership on the strength of some very strong TV ads.

By the early 1990s Thomason Auto Group was one of Oregon’s top privately held companies, with more sales than the Tonkin Family and Lithia Motors, and Thomason’s bespectacled face was becoming a celebrity in its own right. A series of somewhat surreal television ads produced by the Portland agency Nerve featured Thomason’s grinning floating head exhorting the public to buy, buy, BUY. His kicker: “If you don’t come see me today, I can’t save you any money.”

But the car czar ran into a variety of troubles in the early 2000s. He was fined $2.5 million by the Equal Employment Opportunity Commission. He paid the state attorney general $550,000 to settle a pile of consumer complaints. Even his unmistakable face worked against him when he attempted to flee a car accident only to be recognized by bystanders and charged with hit and run. Thomason left Oregon for California in 2003 and became part owner of a new collection of dealerships.

Thomason and his wife, Debbie Autzen, paid $8.5 million for a 10,500-square-foot mansion in Sausalito in 2007. They sold it for $6.8 million last April.

The graying of Oregon

|

John Gray developed the iconic Sunriver resort in Central Oregon, along with Salishan and Skamania Lodge. |

It is tempting to focus on the rogues and the swashbucklers, the booms and the busts, because they tend to make the liveliest stories. But most of the business leaders who define Oregon prefer to work out of the spotlight, bringing people together to get things done, creating wealth through entrepreneurship and giving back through philanthropy. That is how John Gray has done business for decades.

Gray was a World War II veteran who rose through the ranks to become CEO of Oregon Saw Chain Manufacturing Co. He was founder of the chainsaw giant Omark and chairman of Tektronix. But he is best known for his distinctive real estate developments: Salishan on the coast, Sunriver in Central Oregon, John’s Landing in Portland and Skamania Lodge in the Gorge.

His ability to build resorts in harmony with the natural landscape and Oregon’s complex land-use laws set high standards and brought sizable rewards.

Gray sold Omark to Blount in 1985 but he has never really retired from business. In addition to his real estate ventures he has organized in-depth talks between warring sides in the land-use debate and distinguished himself as a generous supporter of a broad array of charities, from the Boy Scouts to the Portland Art Museum to Reed College. Many of his donations have been made anonymously.

Now 91 years old, Gray was the 2010 recipient of the Vollum Award for Lifetime Philanthropic Achievement.

Story by Ben Jacklet

Story by Ben Jacklet