In-N-Out Burger Coming to Beaverton Posted in: Restaurants and Retail - With a new suburban location planned, the popular drive-through inches closer to Portland.

In-N-Out Burger Coming to Beaverton Posted in: Restaurants and Retail - With a new suburban location planned, the popular drive-through inches closer to Portland.

With West End Move, Stumptown Bets Big on Downtown Posted in: Restaurants and Retail - Stumptown VP Jon Perry talks about the chain’s new West End digs, how climate change is affecting producers — and what roasts are best enjoyed in the air

With West End Move, Stumptown Bets Big on Downtown Posted in: Restaurants and Retail - Stumptown VP Jon Perry talks about the chain’s new West End digs, how climate change is affecting producers — and what roasts are best enjoyed in the air

The 2024 100 Best Nonprofits to Work For in Oregon Survey is Open Posted in: 100 Best Nonprofits - Oregon nonprofits can register now through early July at oregonbusiness.com.

The 2024 100 Best Nonprofits to Work For in Oregon Survey is Open Posted in: 100 Best Nonprofits - Oregon nonprofits can register now through early July at oregonbusiness.com.

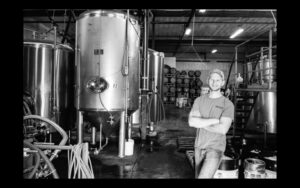

Twenty Oregon Businesses Awarded Rural Energy Grants Posted in: Energy and Environment - The funding will allow Astoria’s Fort George Brewery to install a rooftop solar array, among other projects.

Twenty Oregon Businesses Awarded Rural Energy Grants Posted in: Energy and Environment - The funding will allow Astoria’s Fort George Brewery to install a rooftop solar array, among other projects.

100 Best

Information About The 100 Best Nonprofits Survey - Find out about eligibility requirements, benefits of participation and the schedule of our free nonprofit workplace survey.

Information About The 100 Best Nonprofits Survey - Find out about eligibility requirements, benefits of participation and the schedule of our free nonprofit workplace survey.

2024 100 Best Companies to Work For in Oregon - The companies listed here have demonstrated an outstanding commitment to employment best practices.

2024 100 Best Companies to Work For in Oregon - The companies listed here have demonstrated an outstanding commitment to employment best practices.  100 Best Nonprofits to Work For in Oregon in 2023 - Congratulations to all the organizations who made the list.

100 Best Nonprofits to Work For in Oregon in 2023 - Congratulations to all the organizations who made the list.

POLITICS

Looking Forward, Looking Back - We asked leaders in Oregon’s business and political sectors what they make of 2023 — and what they hope to see in 2024. Here’s what they said.

Looking Forward, Looking Back - We asked leaders in Oregon’s business and political sectors what they make of 2023 — and what they hope to see in 2024. Here’s what they said.

Exit Interview: Blumenauer Says Last Years Were Most Productive - ‘I have a lot of things I want to work on, and I don't think any of them are going to be advanced in a dysfunctional Congress’

Exit Interview: Blumenauer Says Last Years Were Most Productive - ‘I have a lot of things I want to work on, and I don't think any of them are going to be advanced in a dysfunctional Congress’ Oregon, 29 Other State Regulators Reach Settlement in $68 Million Silver Scam - The case alleges defendants deceived elderly and retirement-age customers by inflating the price of its precious metal coins.

Oregon, 29 Other State Regulators Reach Settlement in $68 Million Silver Scam - The case alleges defendants deceived elderly and retirement-age customers by inflating the price of its precious metal coins. Measure 110 Partial-Repeal Would Use Criminal Justice System for Early Intervention - Two alternative ballot measures would recriminalize hard drugs in Oregon, but the organizing group’s founder Max Williams says he hopes the Legislature comes up with a better alternative.

Measure 110 Partial-Repeal Would Use Criminal Justice System for Early Intervention - Two alternative ballot measures would recriminalize hard drugs in Oregon, but the organizing group’s founder Max Williams says he hopes the Legislature comes up with a better alternative.

ECONOMY

Owners of Debt Consolidation Business Face Federal Fraud Charges - Prosecutors seek help building case against ConsoliDebt Solutions.

Owners of Debt Consolidation Business Face Federal Fraud Charges - Prosecutors seek help building case against ConsoliDebt Solutions.

Mac’s List Now Requires Employers to Include Salary Info with Job Listings - A pay transparency bill dissolved in the Oregon Legislature in 2023.

Mac’s List Now Requires Employers to Include Salary Info with Job Listings - A pay transparency bill dissolved in the Oregon Legislature in 2023. Wells Fargo VP Says Declining Interest Rates, AI Are Top of Mind as Businesses Plan For 2024 - As some companies continue to delay buying decisions, Michelle Weisenbach says the declining interest rate environment is signaling companies to invest in technical improvements.

Wells Fargo VP Says Declining Interest Rates, AI Are Top of Mind as Businesses Plan For 2024 - As some companies continue to delay buying decisions, Michelle Weisenbach says the declining interest rate environment is signaling companies to invest in technical improvements. Textured Hair Styling Academy L&M Hair Company Wins $20K Key4Women Grand Prize - The salon was selected from a pool of 212 applicants after making an ‘overwhelming’ pitch

Textured Hair Styling Academy L&M Hair Company Wins $20K Key4Women Grand Prize - The salon was selected from a pool of 212 applicants after making an ‘overwhelming’ pitch

RESTAURANTS AND RETAIL

In-N-Out Burger Coming to Beaverton - With a new suburban location planned, the popular drive-through inches closer to Portland.

In-N-Out Burger Coming to Beaverton - With a new suburban location planned, the popular drive-through inches closer to Portland.

With West End Move, Stumptown Bets Big on Downtown - Stumptown VP Jon Perry talks about the chain’s new West End digs, how climate change is affecting producers — and what roasts are best enjoyed in the air

With West End Move, Stumptown Bets Big on Downtown - Stumptown VP Jon Perry talks about the chain’s new West End digs, how climate change is affecting producers — and what roasts are best enjoyed in the air McCormick & Schmick’s to Close Portland Location Sunday - The closure leaves the chain, which started in Portland, with just one Portland-area location — in Tigard.

McCormick & Schmick’s to Close Portland Location Sunday - The closure leaves the chain, which started in Portland, with just one Portland-area location — in Tigard.  Migration Brewing Wins SBA State Small Business Person of the Year Award - Later this spring, representatives from Migration Brewing will travel to Washington, D.C., to be formally recognized for outstanding entrepreneurship — and could win a national award.

Migration Brewing Wins SBA State Small Business Person of the Year Award - Later this spring, representatives from Migration Brewing will travel to Washington, D.C., to be formally recognized for outstanding entrepreneurship — and could win a national award.

PROFESSIONAL SERVICES

Charges Dropped Against Former Thesis Exec Accused of Embezzlement - Prosecutors say they’ll refile the case, which was dismissed due to a shortage of public defenders.

Charges Dropped Against Former Thesis Exec Accused of Embezzlement - Prosecutors say they’ll refile the case, which was dismissed due to a shortage of public defenders.

After a Landmark Year, Oregon Humane Society Looks Ahead -

After a Landmark Year, Oregon Humane Society Looks Ahead - In 2022 the Oregon Humane Society merged with another shelter system and opened a community veterinary clinic. President and CEO Sharon Harmon says it’s just the beginning.

Wieden+Kennedy Co-Founder Dan Wieden Dead at 77 -

Wieden+Kennedy Co-Founder Dan Wieden Dead at 77 - Wieden, who coined Nike’s “Just Do It” tagline, made memorable ads with an edge.

Death Care Goes Green -

Death Care Goes Green - Oregon becomes the third state in the nation to allow human composting, representing a wider turn towards ecological burial options in the death care industry.

TECH

Spotlight: Micro-Chasm - Oregon’s microfluidics

Tech Hub joins academic and industry partners to help small fluids make a big leap.

Spotlight: Micro-Chasm - Oregon’s microfluidics

Tech Hub joins academic and industry partners to help small fluids make a big leap.

Suitable Tech - How Macro Law Group is using AI — and automation — to upend the way law firms do business

Suitable Tech - How Macro Law Group is using AI — and automation — to upend the way law firms do business Second Sight - Portland’s Synaptiq started by training AI models but is now helping businesses build AI-driven products, especially those that deploy computer vision — a technology that enables computers to derive information from images.

Second Sight - Portland’s Synaptiq started by training AI models but is now helping businesses build AI-driven products, especially those that deploy computer vision — a technology that enables computers to derive information from images.  Locking It Down - Security platform HiddenLayer offers protection for AI systems.

Locking It Down - Security platform HiddenLayer offers protection for AI systems.

ENERGY AND ENVIRONMENT

Twenty Oregon Businesses Awarded Rural Energy Grants - The funding will allow Astoria’s Fort George Brewery to install a rooftop solar array, among other projects.

Twenty Oregon Businesses Awarded Rural Energy Grants - The funding will allow Astoria’s Fort George Brewery to install a rooftop solar array, among other projects.

- NEXT Refinery Project Formally Asks For Lower Rent — Which Records Show It’s Already Paying - A letter from the controversial renewable diesel refinery’s CEO says a boating crash ‘calls into question’ NEXT’s ability to operate the refinery under current conditions.

Merkley, Wyden Pledge $3.5M in EPA Funding For Water Systems in Prineville, Willamina - Communities will use the funds to improve water treatment and install new infrastructure.

Merkley, Wyden Pledge $3.5M in EPA Funding For Water Systems in Prineville, Willamina - Communities will use the funds to improve water treatment and install new infrastructure. More Than 100,000 Oregon Homes Without Power — Some For Days — After Winter Storms - An arctic blast caused small blackouts across the country, but none affecting so many homes as in Oregon, per national tracking tool.

More Than 100,000 Oregon Homes Without Power — Some For Days — After Winter Storms - An arctic blast caused small blackouts across the country, but none affecting so many homes as in Oregon, per national tracking tool.