BY JASON NORRIS | GUEST BLOGGER

BY JASON NORRIS | GUEST BLOGGER

Uncertainty is a part of doing business, whether in through the lens of investment opportunities and risks or the business of running an enterprise.

BY JASON NORRIS | GUEST BLOGGER

The secret of all victory lies in the organization of the non-obvious. — Marcus Aurelius

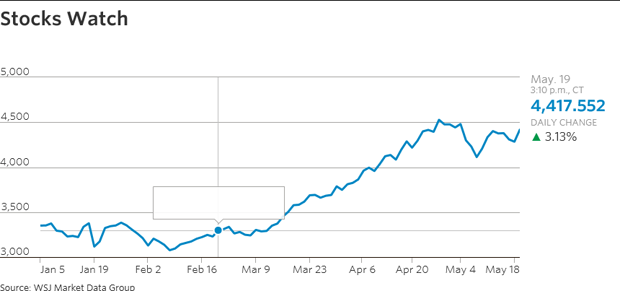

Stocks continue to grind upward in the month of May with the S&P 500 hitting new highs. Economic uncertainty has resulted in investors believing the Fed won’t raise rates until late 2015 … or even 2016. The continuation of low interest rates in the U.S. has been one of the factors pushing stocks higher and the headwinds we noted in April were not the detriment investors expected in the first quarter.

At the beginning of earnings season in April, investors were anticipating three consecutive quarters of negative year-over-year earnings growth. With 93 percent of companies having now reported first quarter earnings, year-over-year growth should come in just under 1 percent. This “positive” surprise has enabled market expectations to remain at 2 to 3 percent earnings growth for 2015. Economic data so far this year has been a bit spotty and has not improved as much as we would have expected over the last couple months; however, profitability continues to trend higher with the expectation of record operating margins for 2015.

While stocks are near all-time highs, we don’t believe there is a “bubble” in the market due to reasonable valuations and positive earnings growth. But stocks aren’t the only investment vehicle in town. As investment managers, we are cognizant of possible bubbles outside of equity or bond markets since they can have ramifications in the public markets.

German 10-Year Debt

Source: Bloomberg

So, where are the potential bubbles? It looks like we saw one in European debt. One month ago, bunds (German 10-year-debt) were yielding 0.11 percent. As of mid-May, those same bonds were yielding 0.65 percent. This spike in yield resulted in a 10 percent decline in value in what has historically been seen as a “safe” security. Several hedge funds that owned these bonds experienced poor performance in April (and likely in May). An argument could be made that the recent parabolic move in Chinese equity markets may constitute a bubble.

Shanghai Composite

A record $179.4 million for a Picasso may signify a bubble or alternatively, like real estate, equate to a store of value. Within real estate, it is getting difficult to justify the meteoric appreciation in select markets, such as New York City, San Francisco and Vancouver, BC.

While high prices and upward momentum don’t necessarily signal excess, as investment managers it is our job to assess the investment opportunity. Each marketplace has different dynamics, thus price and direction may not constitute a bubble.

The Coin Flip

From the global economy to what’s happening here in Oregon

Along with assessing investment risk, it is imperative that we assess business risk. As a fiduciary, we are put in a position of trust with our clients. While we strive to exceed our client expectations on the investment front, we also must do the same on the operations front. This requires investment in technology for security, connectivity and backup. It is important for individuals and institutions when they are evaluating an investment manager and custodian for their assets. As we’ve learned recently, cyber theft is becoming a major business risk.

Business continuity is also critical issue. Many may recall in December of 2013, there was a significant electrical failure in downtown Portland, which made the office space for Ferguson Wellman – and its division, West Bearing Investments – challenging for conducting business. Fortunately, due to disaster planning, we were able handle client business remotely and reinforced that preparing for a wide range of hazards enabled us to continue to work. Oregon Business recently hosted a panel that highlighted what businesses can do to prepare for those rare, but very costly disasters.

Uncertainty is a part of doing business, whether in through the lens of investment opportunities and risks or the business of running an enterprise. As a fiduciary, investment advisors need to be focused on both sides of the coin.

- Jason Norris, CFA, is executive vice president of research at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.

BY JASON NORRIS | GUEST BLOGGER

BY JASON NORRIS | GUEST BLOGGER