Yogi Berra’s interesting perspective on the past and future certainly rang true regarding the interest rate environment we have now finally entered. Last Wednesday, the Federal Reserve raised the federal funds rate by 0.25 percent to 0.50 percent. This has probably been the most anticipated hike in history and was viewed with a sigh of relief from investors, primarily due to the clarity and predictability it brings from the Fed. While rates will continue move higher over the next few years, the anticipation of the initial hike was causing angst in the equity and debt markets. Wells Fargo’s CEO recently stated that the “debate is greater than the rate.” This initial hike is a sign that the U.S. economy is on a sustainable path, as Chair Janet Yellen stated in her press conference. While 2.00 percent GDP growth may not be robust, it is a healthy sign that the U.S. economy is well beyond its recovery stage and in firm expansion.

The two most common questions we hear from clients regarding the Fed hike are, “Will this put the economy back in recession and how will this impact stocks?”

First, the Fed isn’t raising rates not to stop inflation, as we saw in the early 1980s, nor to pop a bubble, as we saw in the late 1990s. The Federal Reserve believes, as we do, that the U.S. economy is healthy enough to enable interest rates to “normalize,” which should be closer to economic growth (around 2 percent).

However, the Fed realizes that they can’t act too aggressively, thus future rate hikes will be gradual.

The rate cycle 10 years ago was both fast and frequent. Over the course of 30 months, the Fed raised rates 425 basis points (or 4.25 percent) from 1.00 percent to 5.25 percent. We believe that this cycle will be considerably slower with a target of 225 basis points over the next 30 months. This slow and steady move should not hamper the economy, thus we do not anticipate a recession in the near future.

So what does this mean for investing? With regard to bonds, rising interest rates will be a headwind to returns because as rates rise, bond prices decline. The key to investing in this environment is to purchase individual bonds that have short maturities, which provides the flexibility and liquidity to reinvest more frequently at higher rates.

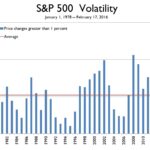

When considering stocks, we still believe that U.S. companies will grow their earnings in 2016, thus equities should exhibit positive returns. Historically, when the Federal Reserve raises rates at a slow, gradual pace, stocks usually respond favorably, as seen in the chart below.

Since this is the first rate hike that investors could follow on Twitter, there might be some uncertainty around the reaction of investors who may not have experienced a cycle of rate hikes before.

Rock Bottom

We have been in an environment of federal funds rate right above zero for close to 10 years, which is a long time for investors who are seeking income from interest-bearing investments. This search for yield as resulted in investors putting money in areas they may not fully understand. Two popular vehicles have been high-yield bond mutual funds and master limited partnerships (MLPs). Both of these asset classes have high exposure to energy prices. Thus, as oil prices have fallen, it has put pressure on securities in this space, as seen in the chart below. This has resulted in one particular high yield mutual fund halting redemptions because they have been unable to sell their investments. Brad Houle, CFA, focused on this recent development in his blog entry for Ferguson Wellman on December 18.

While it is too early to see if the income component of these investments takes a major hit, the value of the investments certainly has. Investors have to do their due diligence when investing in any area and not get “blinded” by an attractive yield component.

*Yogi Berra

The Coin Flip

From the global economy to what’s happening here in Oregon

Oregon’s Interest in Rates

BY MARY FAULKNER

Star Wars wasn’t the only force to awaken last week, with the Fed nudging rates with careful conviction for the first time in nearly 10 years. Although the S&P 500 welcomed the change with open arms – how did it make the typical Oregonian feel?

Here are a couple things to consider should you think the sky is falling as rates go up. A rate increase is a good thing. It means the Fed finally has some monetary policy resources to tap into if needed. More people are employed, GDP continues to rise slowly and there are no signs of a recession heading our way. Now is a time to feel good about the economy and hopefully your personal balance sheet.

With the prime rate inching upward, any outstanding loans you have may result in you paying slightly more. The margin rate on your equity investment accounts may be increasing as well. Unfortunately, you may not see an increase in your savings rate as quickly as your loan rate because there tends to be a lag with banks on this front.

The 10-year Treasury yield is typically the benchmark on mortgages, thus there is no direct impact from an increased federal funds rate. It is, however, impacted by inflation and economic growth expectations. Therefore, with inflation low and growth steady, we don’t expect a meaningful increase in interest rates in the near-term. This coupled with the hot housing market seen in Oregon, it is likely that you are still “sitting pretty” with the investment in your home or rental property.

- Jason Norris, CFA, is executive vice president of research and Mary Faulkner is senior vice president of branding and communications at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.

Disclosures:

Opinions and statements of financial market trends based on current market conditions constitute our judgment and are subject to change without notice. Due to the rapidly changing nature of the financial markets, all information, views, opinions and estimates may quickly become outdated and are subject to change or correction. We believe the information provided is from reliable sources but should not be assumed accurate or complete.