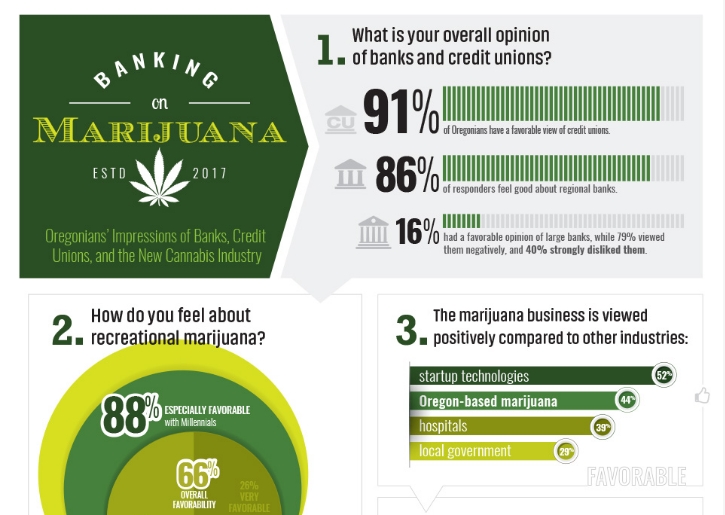

New survey indicates financial institutions could bolster image by accepting deposits and lending to legal marijuana businesses

LT Public Relations (LTPR) and DHM Research today released results from a first-time study on the public’s perception and reputational effects of banks and credit unions providing financial services to the legal marijuana industry. The scientific study conducted in November 2016 specifically surveyed residents in Oregon, where recreational marijuana was officially legalized on July 1, 2015. Complete details about the survey, including an analysis of the findings and a list of seven key insights are available here and here.

“Banks and credit unions now have quantitative research on the public’s perceptions of servicing the legal marijuana industry to rely upon. The data about the opinions of potential members or customers will help financial institutions make informed decisions about if and how they pursue providing needed financial services to this developing industry,” says Casey Boggs, president of LT Public Relations.

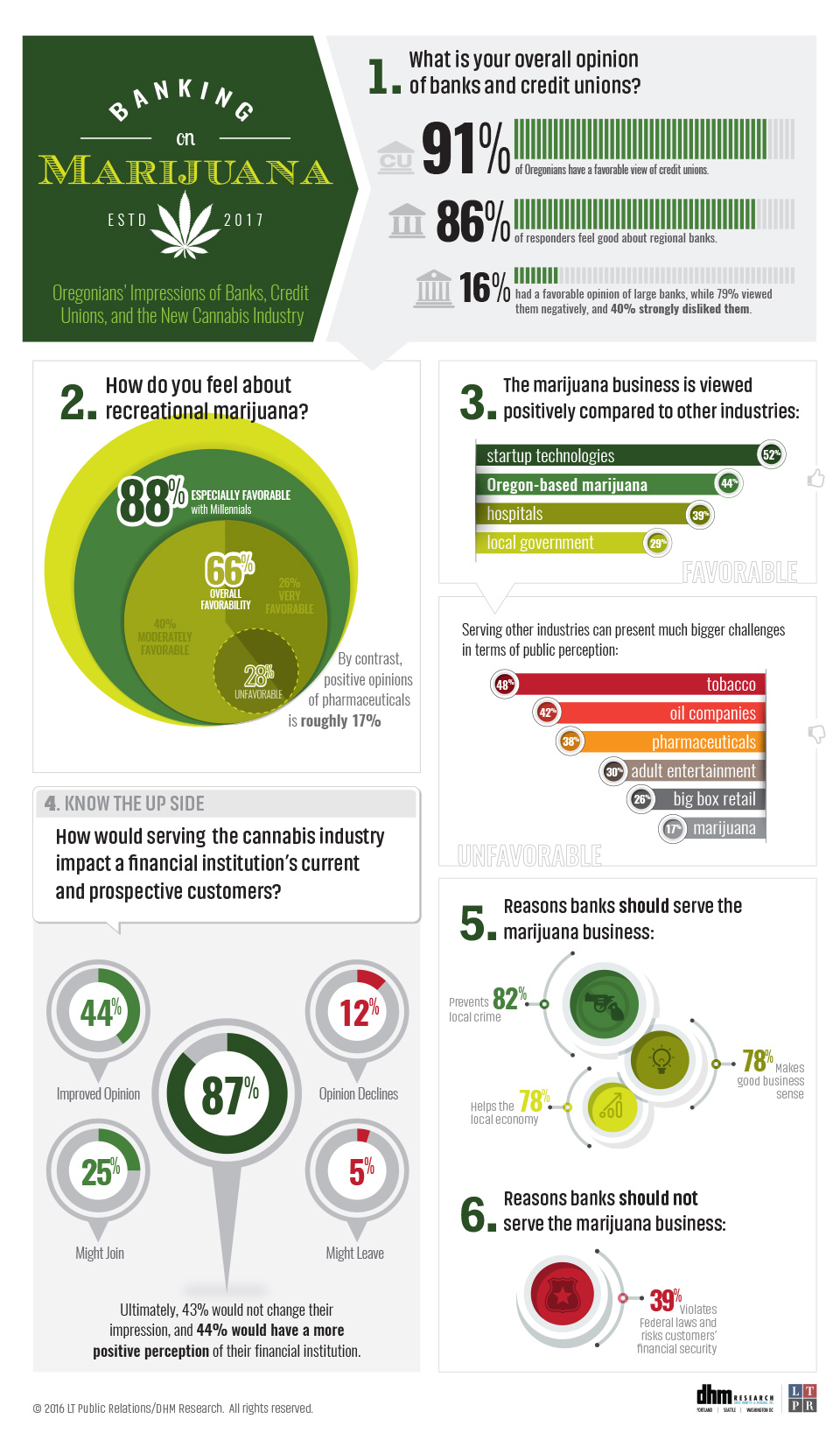

According to the research, reputational concerns banks and credit unions may have about working with marijuana businesses appear largely unfounded. If attitudes of Oregonians are a good barometer, then banks and credit unions in states where recreational marijuana is legal may have stronger reasons to enter the market than they do to abstain.

“This is a new area of research” says Su Midghall, president and principal of DHM Research. “This survey shows that Oregonians support credit unions and smaller banks in general, and are in favor of these institutions doing business with the marijuana industry. Voters approved the sale of recreational marijuana, and, based on our research here and elsewhere, the public views the industry like other businesses. Oregonians don’t see why banks can’t help marijuana businesses, especially if it would improve public safety by removing their dependence on cash.”

As reported by American Banker, a 2015 survey by Marijuana Business Daily of 400 professionals in the cannabis industry found that 40% had bank accounts. According to the Associated Press, federal data from March, 2016 indicated that nationwide, 301 banks and credit unions were willing to handle pot money; however, in Oregon, there is currently only one financial institution that openly serves marijuana businesses.