There are many ways to look at economic trends. Each month, analysts at Ferguson Wellman Capital Management share how global economic data and market trends are viewed here in Oregon.

Back in Business Again

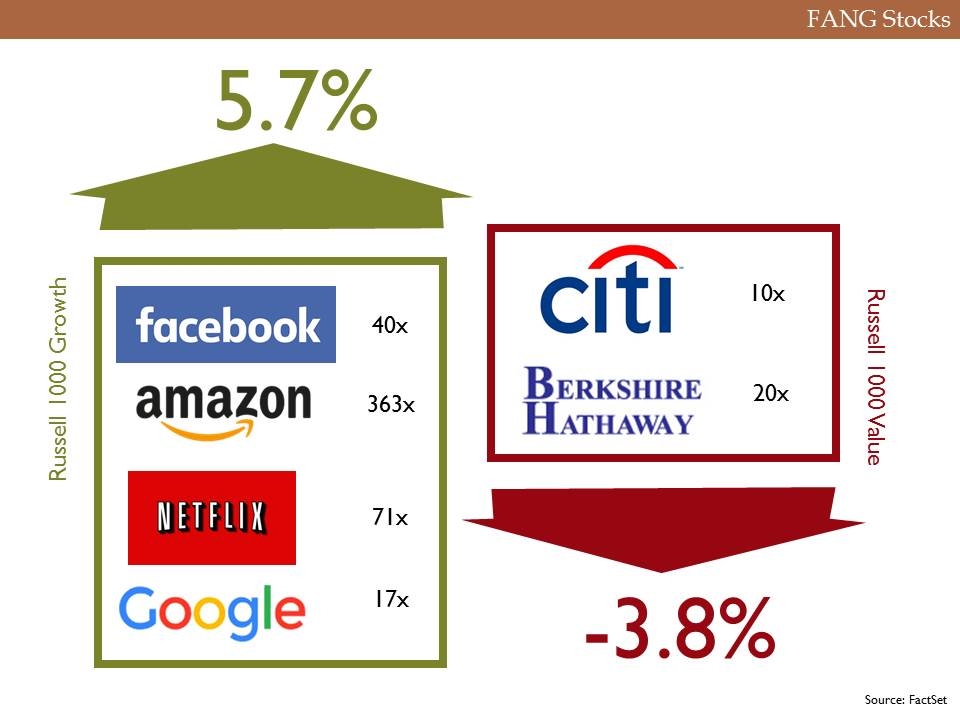

The last several years, equity markets have been led by large-cap growth stocks. This was highlighted last year as the broad markets finished flat-to-down while a narrow set of “growth” stocks rallied higher.* CNBC pundit Jim Cramer even coined the acronym, “FANG,” which represented Facebook, Amazon, Netflix and Google. 2015 was not a year to diversify; it was the year to focus on big-cap growth, specifically FANG. The Russell 1000 Growth Index, which is a measure of the largest growth stocks in the U.S., was up just under 6 percent while the Value Index was down close to 4 percent.

The infamous FANG stocks rallied close to 70 percent, which was due to concerns over economic growth. Historically, investors prefer to buy “cheap” or “value” stocks to maximize their future returns. However, value stocks are more dependent on economic growth for their earnings. So if growth is slowing or uncertain, investors will look to companies that can still thrive in such an environment. The FANG names are emblematic of this. In this process, however, investors will bid these names up despite minimal earnings.

The chart above shows what the price-to-earnings (P/E) multiple was for the FANG stocks on January 1, 2015. To put it in perspective, the S&P 500 had a P/E multiple of roughly 15x. In a growth market, all that matters to investors is earnings growth and valuation is less important. Over the long term, buying high P/E stocks usually leads to worse performance than buying low P/E stocks; however, there can be extended periods where this is the contrary as seen during the late-1990s tech bubble. This narrow, focused market resulted in over 75 percent of active managers trailing their benchmarks. As managers increased diversification, performance suffered.

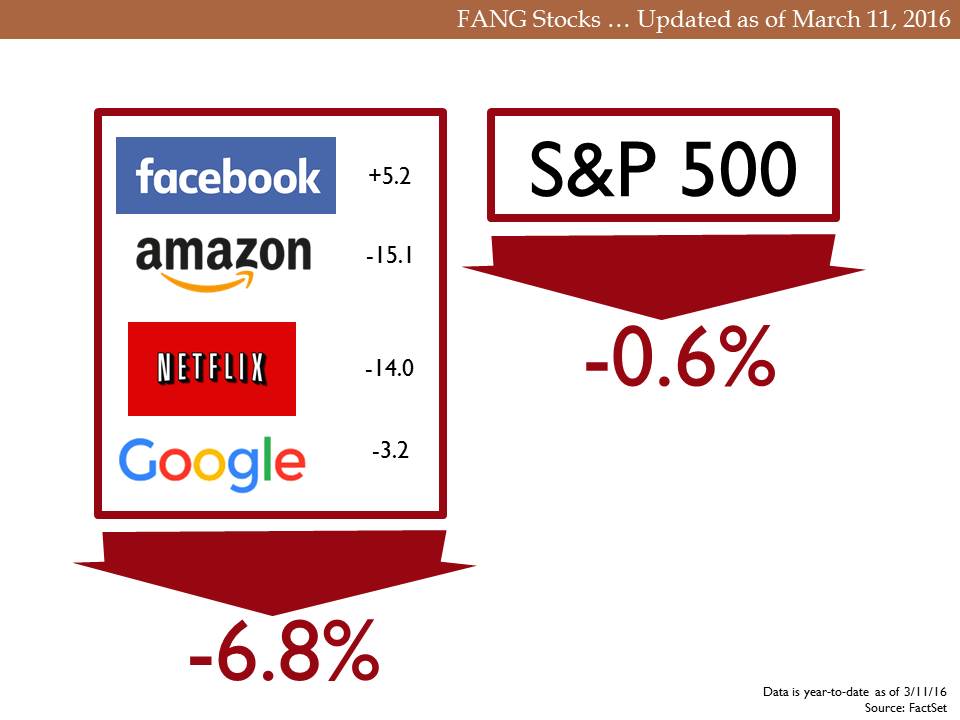

This is important because we believed that we would see a change in 2016. Our view was and continues to be that the U.S. economy is improving. While earnings have been pressured by the strong U.S. dollar and low oil prices, this will abate in 2016. Therefore, “value” stocks will do better than “growth” stocks. The more expensive the growth stocks … the more they will lag. We advised our clients not to “change lanes” and chase those growth names that worked in 2015. The chart below shows the performance of FANG stocks as of March 11, 2016.

The broader growth and value indices show the same trends, with growth down over 2 percent and value slightly positive. While we are less than three months into 2016 and there is still ample time for changes in investor sentiment, we continue to believe that value will continue to outperform. The U.S. economy is improving, employment is very healthy and consumers have de-levered. Earnings will reaccelerate in 2016 and 2017 from flat profit growth in 2015.

The Coin Flip

From the global economy to what’s happening here in Oregon

An example company close to home is Nike, which has been one of the more popular growth names over the last couple years. In the last five years, the stock has returned over 25 percent per year, more than doubling the return of the S&P 500 over that same period. What drove these returns was close to a doubling in profits for Nike. However, it did result in their P/E multiple to increase from 17x earnings to 25x. If we move to a “value” market, Nike and other similar growth stocks most likely will lag based on its premium valuation; however, earnings are forecasted to grow 15 percent, which will offer some support.

This is the ideal investment: buy an “affordable” stock and have it deliver strong earnings growth, as well as an increasing P/E multiple.

*Investing has a lot of different styles. A common contrast in equity investing is between growth stocks and value stocks. Growth stocks are usually defined as companies that are growing faster than the average; however, also priced at a premium to the average. Value stocks typically grow less than the average and are priced at a discount.

Jason Norris, CFA, is executive vice president of research and Mary Faulkner is senior vice president of branding and communications at Ferguson Wellman Capital Management. Ferguson Wellman is a guest blogger on the financial markets for Oregon Business.

Disclosures:

Opinions and statements of financial market trends based on current market conditions constitute our judgment and are subject to change without notice. Due to the rapidly changing nature of the financial markets, all information, views, opinions and estimates may quickly become outdated and are subject to change or correction. We believe the information provided is from reliable sources but should not be assumed accurate or complete.