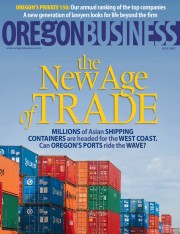

Global freight traffic is up and the Port of Portland is poised for growth, as long as congestion doesn’t derail it.

Rising tide

Global freight traffic is up and the Port of Portland is poised for growth, as long as congestion doesn’t derail it.

By Christina Williams

The Port of Portland is small. Dinky, even. It’s 104 miles up a river and even when dredging is completed on the Columbia it’s not going to be able to accommodate the huge new container ships that are blazing around the globe these days.

But supporters of the port are optimistic despite these shortcomings for one simple reason: As the U.S. appetite for foreign goods continues to swell, freight moved in this country is expected to double in the coming decades, with most imports coming from Asia and looking for a place to land on the West Coast.

A port like Portland’s, which moved 214,484 20-foot equivalent units (TEUs) through its marine terminal last year, can grow fat off the crumbs of super-ports like Long Beach and Los Angeles, which moved more than 15 million TEUs between them. Even the ports of Seattle and Tacoma, which moved about 2 million TEUs each last year, have business to share. (A TEU is a shipping-industry measurement used to count empty and full containers.)

After a couple of rocky years that saw the port losing two major international shipping lines, the Port of Portland was the only Northwest port to see growth in 2006, increasing its freight traffic by 33%. Its low profile is being marketed as an asset as shippers look to avoid the congestion of Southern California.

Terminal 6, Port of Portland Photo by Adam Bacher |

“I can tell you that 10 years ago, I would have sat right here and said there will only be two super-ports [on the West Coast], Southern California and the Puget Sound,” says Dale Sause, president and CEO of Coos Bay-based marine cargo company Sause Bros. “I would have said everything in between didn’t count. But I can’t say that same thing now. We are in a new world.”

But, if Portland, which works closely with Washington’s Port of Vancouver (which, at just 197 TEUs moved last year is even smaller than Portland), is a diamond in the rough for shippers who want to hedge their bets by bringing cargo into the U.S. through a less-congested port, it certainly isn’t the only one. Newly developed ports in Mexico and Canada are also gearing up to absorb more West Coast trade traffic and will be competing for the same shipping business with the same low-hassle marketing message.

To win in the trade game, the Port of Portland has to give shippers what they want: conven-ient access to markets. With its paltry population, Oregon isn’t a hotbed of consumers hungry for Asian imports, but with two national rail lines and two interstate highways crisscrossing near its largest port, the state could position itself as a gateway to the Midwest.

The problem is that in their current condition the capacity of the state’s highways and rail lines is not sufficient to support such a claim. And while the Port of Portland is picking away at the improvements it can make itself, the authority and the money to make upgrades to the transportation infrastructure is tough to pin down.

FOR AN INDUSTRY THAT’S AS OLD AS THE HILLS (the Port of Portland was founded in 1891 to oversee shipments of wheat to England), it’s a dynamic time to be in the port business. The sheer volume of imports coming from Asia is continuing to bolt upward and the game plan for how to get all that stuff into the hands of consumers is changing quickly.

“Shippers are looking at every little dent in the coastline wondering if they can make it work,” says Port of Portland executive director Bill Wyatt. “Just the other day, China Ocean Shipping Company announced it would start sending large container ships to Prince Rupert. It’s not because there’s a market there.”

That the world’s largest steamship company would sign up to be the first customer for an untried port in British Columbia — Prince Rupert’s new cargo terminal is set to open this fall and a rail line will take shipping containers straight into the U.S. heartland — is a demonstration of how the desire to avoid the congestion of the big ports has affected the market.

“Shippers are looking at every little dent in the coastline wondering if they can make it work.” — Bill Wyatt, executive director, Port of Portland Photo by Adam Bacher |

And news this spring that another shipping giant, A.P. Moller-Maersk Group, is eyeing Coos Bay for a terminal that would be similar to the one in Prince Rupert highlights the fact that Oregon could benefit — in the form of the jobs and revenue that come from handling freight — from the growing demand for port capacity.

In May, several hundred people representing North-west ports, shippers, logistics companies and manufacturers converged in Portland for the first Northwest Intermodal Conference, a meeting to discuss the issues that Northwest ports face — namely not enough railroad capacity, not enough truck capacity, not enough people, not enough love from the general population and not enough sunshine.

One after another, presenters at the conference, representing all sides of the businesses, begged for more cooperation among shippers, ports and customers and more funding from the federal government. Doug Tilden, CEO of Marine Terminals Corp., an Oakland, Calif.-based terminal operator, put it this way: “If the national infrastructure is behind, and it is, then this discussion really belongs on the federal level.”

The Port of Portland’s version of the outdated in-frastructure nightmare is being called the Portland Triangle Bottleneck. The interstate railroads, Burlington Northern Santa Fe and Union Pacific, both of which have tracks through Portland, are running longer trains in order to increase their efficiency which require more yard capacity and more tracks to allow trains to meet and pass. A complex web of rail lines, switches, yards and terminals converges in Portland.

A study completed last year for the port identifies rail as one of the port’s biggest issues. Rail congestion threatens to erode the Portland/Vancouver port system’s major asset: its reputation as a more manageable and less choked port than those in Southern California.

But clearing the congestion becomes more complicated when you consider that BNSF and UP, while they do share tracks where it makes sense to both sides, are highly competitive with each other and often don’t play nicely. And both railroads are investing in system improvements in proportion to where they’re seeing the most traffic — mostly along lines that serve the larger ports.

“The railroads say they will offer intermodal service as long as there is traffic to support it, so Portland will have to come up with that volume,” says Monica Isbell, a logistics expert with Portland-based Starboard Alliance Company. “But the railroads are going to have to invest in Oregon at some point.”

Both railroads are making incremental improvements to their tracks, but for a major increase in capacity it will take more decisive action. For example, one proposal in the port study calls for a track sharing agreement between BNSF, which owns and operates the rail line north of the Columbia River Gorge, and Union Pacific, which owns the track on the south side, that would have both railroads running all their eastbound trains on the south side and all westbound trains on the north side. The result would immediately double the capacity of the important east-west corridor for both companies, but neither railroad is willing to entertain the possibility at this time.

Wyatt and other industry experts expect that this kind of cooperation will happen eventually, but not until both sides are feeling the pain, sometime in the next decade or two. “These things happen when everything is on the verge of catastrophe,” says Wyatt.

Wyatt makes the comment with a wry smile, but waiting for a catastrophe is no way to run a business.

PORTLAND HAS ANOTHER MOTIVATOR for fixing its transportation issues and winning more import traffic: empty containers.

Oregon’s always been an export-heavy state, shipping lumber and agricultural goods, and the state still has plenty to sell. The Port of Portland is the third-largest export center for grain in the world and the largest wheat export port in the United States. Top exports by volume include wheat, potash, soda ash (both used in making glass and detergents) and compressed hay. By pursuing importers, the port ensures that Oregon exports have a ready ride to Asia.

In 2003, Virginia discount retailer Dollar Tree opened a distribution center in Ridgefield, Wash. Now the Port of Portland is the No. 1 U.S. port for Dollar Tree’s considerable Asia import trade.

Columbia Sportswear’s port traffic has mirrored the port’s fortunes. In 2004, 90% of Columbia’s imports — clothing and footwear manufactured in Asia — came through the Port of Portland. In 2005, Columbia opened a footwear distribution facility in Kentucky, requiring the company to route more of its cargo through Southern California. At the same time, the Port of Portland lost two container shipping lines, forcing more of Columbia’s cargo up to Seattle. Now that container traffic is back up in Portland, Columbia routes half of its cargo through its home port.

During the port’s lean years of shipping service, Oregon agricultural exporters either had to pay to get their goods up to Seattle for shipping or forgo exporting altogether. Port officials are still working to get their import volume up to where it was earlier this decade, but with the incoming volume of trade from Asia, the port would have to try pretty hard not to grow in the coming years.

Assuming, of course, that the rail congestion issues are addressed. Congestion will get worse if Maersk starts sending shipping containers from a new terminal in Coos Bay on trains up to Portland.

The Port of Portland must get serious about finding creative financing opportunities to build the infrastructure it will need to take advantage of what is shaping up to be the age of trade.

One example of cooperative financing sits just to the west of Terminal 6: the Ramsey Rail Yard. Wyatt credits U.S. Rep. Earl Blumenauer with securing $7.1 million in 2005 federal funds to improve the yard for more rail car capacity. The 2006 ConnectOregon bill kicked in another $6.8 million, and the project was rounded out by a contribution from BNSF. Completion of the yard, expected by June 2009, will make it easier for the terminal to accommodate long freight trains, but more than a place to stash rail cars, Ramsey represents the kind of cooperative funding magic Oregon will need to see more of in the near future to beef up its container capacity.

Jay Waldron, who hands over the title of Port of Portland Commission president to former PacificCorp CEO Judi Johansen this month, is more optimistic now about the port’s prospects than he’s been during his six years as head of the commission. Despite the fact that ports in Washington get nine times more tax revenue than does the Port of Portland, Waldron says that smart investments, helped along by ConnectOregon funds — ConnectOregon II is expected to be passed this legislative session — will help the port take advantage of new opportunities.

“With bulk, low-margin freight we’ve been doing great,” Waldron says. “With container freight we’re positioning ourselves to do better.”

Have an opinion? E-mail [email protected]